Crypto Download #54

Stimulus Negotiations Underway $2T vs. $618B; Global Central Bank Monetary Stimulus Full Throttle Ahead; Bitcoin Narrative as a Savings Account Grows; ETH DOT LINK - Don't Sleep on These Alts

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

U.S. Hits Pandemic Milestone With More Vaccinated Than Cases

Russia's Sputnik V vaccine 91.6% effective in late-stage trial

Alcohol Deaths in England and Wales Hit a Record in Lockdown

Fed’s Kashkari: Fed Shouldn’t Pull Back on Aid: The U.S. economy has a long way to go before it fully recovers and will need strong support from the Federal Reserve and the broader government to get there, Federal Reserve Bank of Minneapolis President Neel Kashkari said Monday. Read More.

“The key now is for the Fed to keep its foot on the monetary policy gas” to help the economy overcome the coronavirus pandemic, Mr. Kashkari said. He also said it is critical that fiscal aid be in the mix as well, adding the central bank will use all available tools to help achieve its job and inflation goals.

Ms. Daly (Federal Reserve Bank of San Francisco leader) also said it would be critical for the Fed to maintain its support when the economy shows signs of improvement to help those hurt most by the pandemic. “We have to resist our temptation to worry that inflation of double digits is around the corner and put the reins on the economy before we get the momentum that is required,” she said.

Biden Meets Republicans to Discuss Their Covid-19 Stimulus Plan: A group of Senate Republicans outlined their roughly $618 billion coronavirus-relief offer Monday, including a round of $1,000 direct checks for many adults, as Democrats began a process that would allow them to pass President Biden’s $1.9 trillion plan along party lines. The 10 Republican senators met with Mr. Biden Monday evening to discuss their proposal, which would provide $300 a week in enhanced federal unemployment benefits through June, versus the $400 a week through September in the Biden plan. The GOP proposal also outlines $20 billion each for child care and schools—both lower than the Biden proposal—as well as $50 billion for small-business relief and $160 billion for vaccines, testing and protective equipment, according to a summary released Monday morning. Read More.

“It was a very good exchange of views. I wouldn’t say that we came together on a package tonight. No one expected that in a two-hour meeting,” Ms. Collins said outside the White House.

“While there were areas of agreement, the president also reiterated his view that Congress must respond boldly and urgently and noted many areas which the Republican senators’ proposal does not address,” Ms. Psaki said.

“It makes no sense to pinch pennies when so many Americans are struggling,” Mr. Schumer said Monday.

“He seems committed to try and get to a bipartisan deal, and he understands that the reconciliation process will delay some aspects of his plan,” Mr. Cassidy said of Mr. Biden.

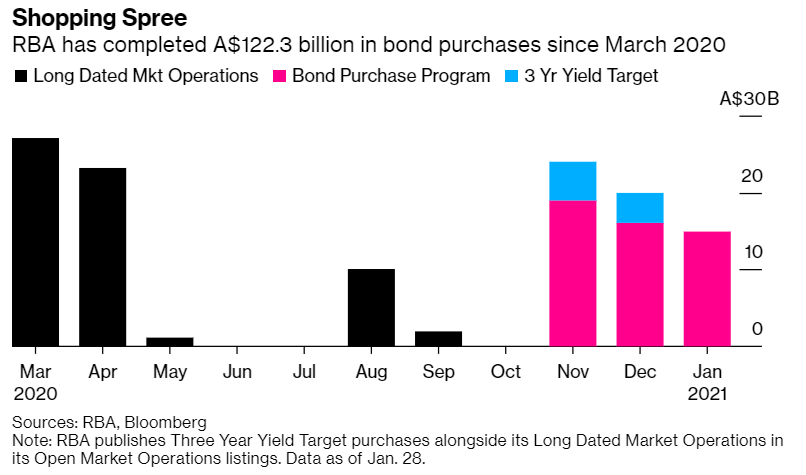

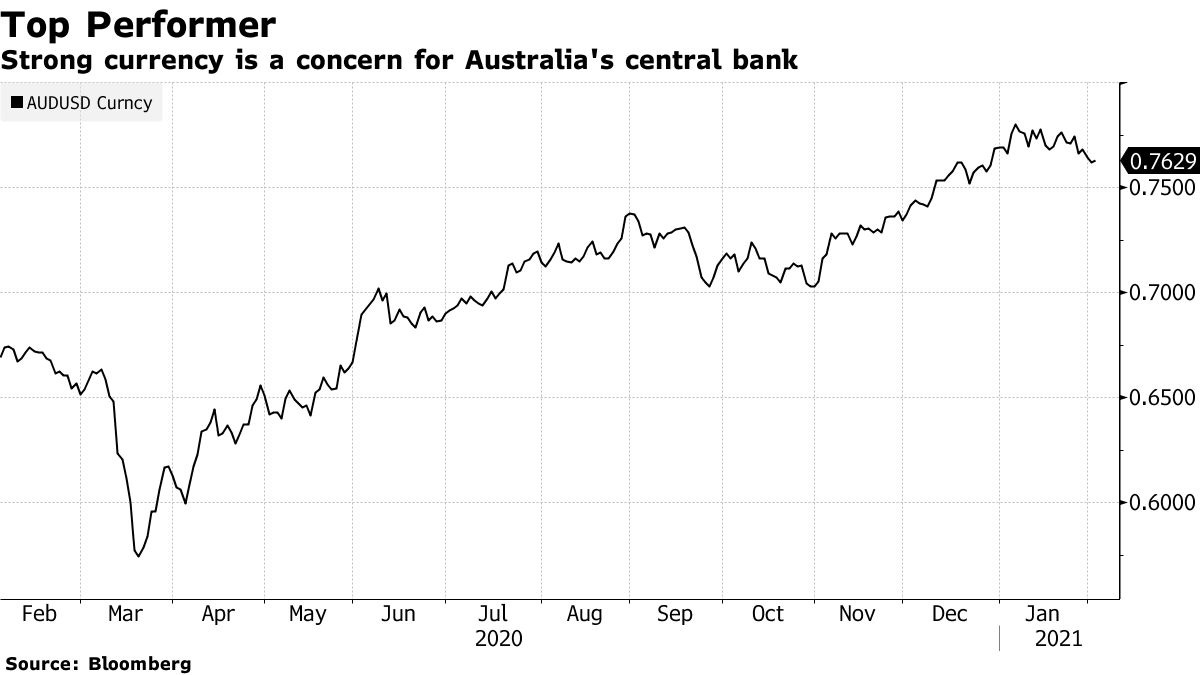

Australia Extends QE Program to Stay Inline With Global Peers: Australia’s central bank will extend its quantitative easing program by a further A$100 billion ($76.2 billion) and doesn’t expect to increase interest rates until 2024, following in the footsteps of global peers in moving to stamp out premature tapering speculation. Governor Philip Lowe left the key rate and three-year yield target at 0.10%, the Reserve Bank said in a statement Tuesday. In addition to the QE program now extended beyond mid-April, the RBA also operates a bank lending facility. Read More.

“The board will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range,” Lowe said. “For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labor market. The board does not expect these conditions to be met until 2024 at the earliest.”

BOE Likely to Embrace Negative Interest Without Using Them: The Bank of England is preparing to take a significant step into the debate on whether negative interest rates should be used to stimulate the coronavirus-stricken U.K. economy. The central bank this week is due to publish the results of 160 detailed responses to a consultation about how borrowing costs could be pushed below zero for the first time since it was founded in 1694. The controversial policy, already tried in the European Union and Japan, turns banking on its head by charging for deposits while paying those who borrow money.

There are concerns that negative rates will shrink commercial banks’ margins, making them more reluctant to extend loans at the moment when the economy needs it most. Europe’s half-decade experiment with the policy has put pressure on revenue and burdened lenders with penalties for parking cash with the central bank. Negative rates may also distort the traditional dynamics of borrowing and lending, with some wealth managers charging their clients for deposits. Read More.

“In the long run, negative rates ruin the financial system,” Deutsche Bank AG Chief Executive Officer Christian Sewing said in 2019.

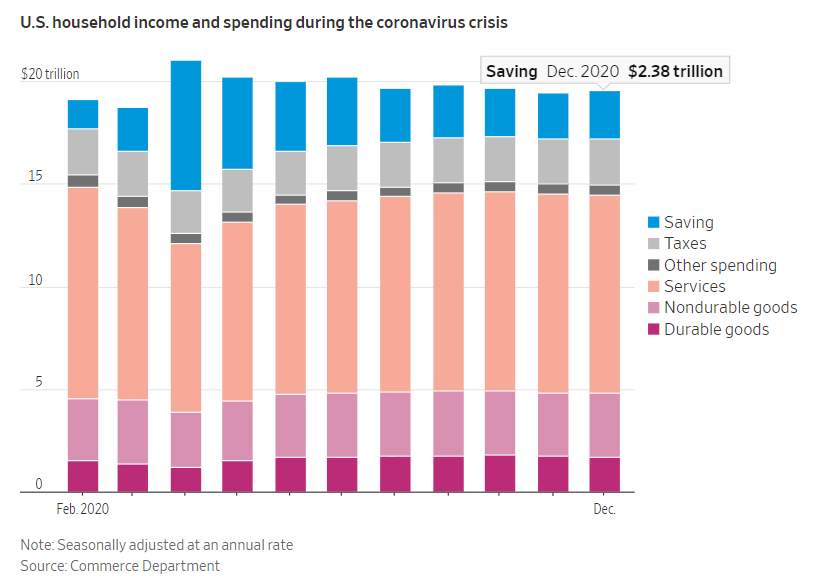

U.S. Household Income, Savings Rose at End of Last Year: U.S. household income rose for the first time in three months in December as a new round of government-aid efforts kicked in, priming the economy for stronger growth this year once the pandemic recedes and businesses fully reopen. Americans have had limited ways to spend their money, because of pandemic-related shutdowns. Consumer spending fell 0.2% last month, marking the second straight monthly decline. Households cut spending broadly on goods, particularly big-ticket items such as cars and household appliances, while spending on services rose only slightly. The weak spending has left Americans with historically high savings that could enable them to boost spending later this year. The personal savings rate rose to 13.7% last month, far higher than the pre-pandemic level of roughly 8%. Excluding last year, the savings rate is at the highest level since 1975. Read More.

Bitcoin

Bitcoin Accounts Offer 3% Rates in a Low-Interest World: The era of earning decent interest rates on savings may not be returning anytime soon, as the global economy struggles to recover from the Covid-19 pandemic. Yet a new crop of financial products has emerged offering eye-popping annual rates of 3% to 12%. These types of incentives, once offered by a handful of crypto outfits such as BlockFi, have been proliferating as competition between exchanges heats up. With Bitcoin surging seven-fold since March and mainstream institutions embracing crypto like never before, companies are seeing an influx of new investors opening accounts. Read More.

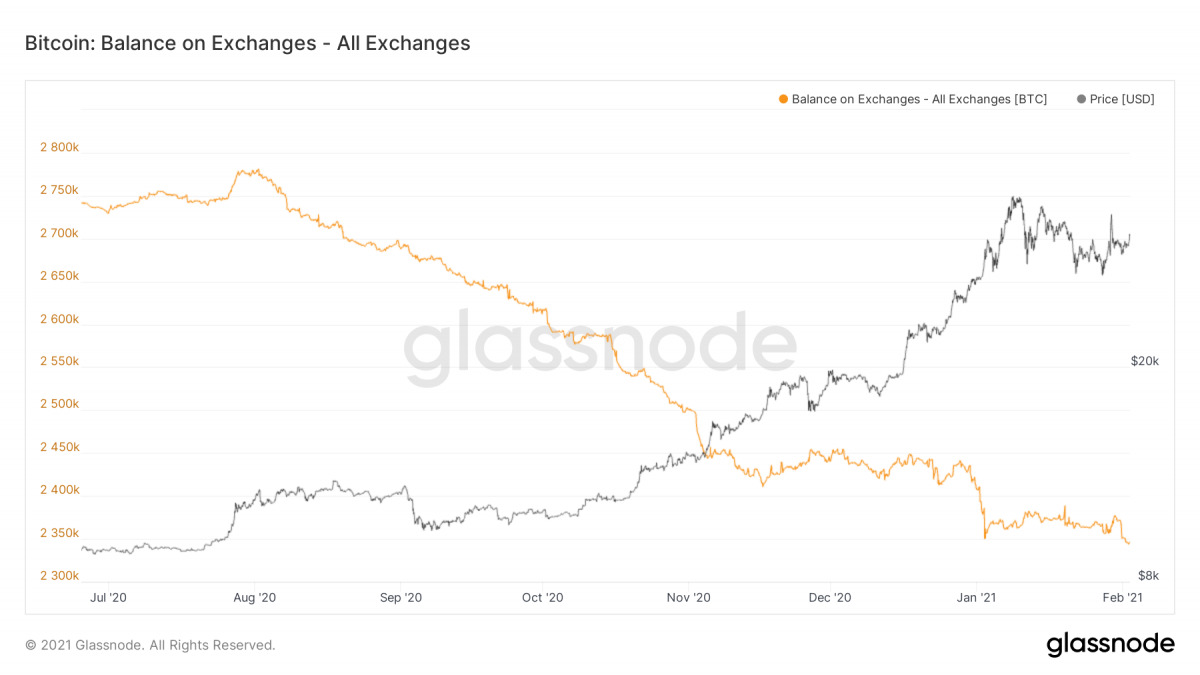

Bullish Bitcoin Fundamentals Point to Renewed Price Rally Ahead: Bitcoin’s on-chain metrics are painting a bullish picture after weeks of consolidation. The top cryptocurrency hit a peak price of $41,962 on Jan. 8 and has mostly traded the range of $29,000–$40,000 since. However, demand continues to outstrip supply amid the price lull. “In 2021 so far, around 26,000 BTC have been mined. Meanwhile, The Grayscale Investment Trust has acquired over 40,000 BTC in the same period.” Glassnode said. Further, the number of coins held on exchange addresses continues to slide, taking sell-side liquidity off the market. Read More.

MicroStrategy Drops Another $10 Million on Bitcoin: The business intelligence firm has picked up a further 295 Bitcoin as its holdings grow to $2.5 billion. The firm has purchased 295 more Bitcoin, bringing its total holdings to 71,079. The average price it paid for this Bitcoin was $16,109. Read More.

Coinbase Picks Nasdaq for Direct Listing: After months of speculation, San Francisco-based crypto exchange Coinbase recently announced plans to go public via a direct listing. Now, The Block reports that the company will list its shares on Nasdaq. Coinbase quietly filed a draft of its registration with the US Securities and Exchange Commission (SEC) back in December, and the direct listing was officially announced last week. Unlike an IPO, a direct listing doesn’t involve creating new shares. Coinbase has launched a secondary market for private shares with Nasdaq’s Private Market service, which has already implied a valuation of around $50 billion. Read More.

Crypto

21Shares Launching First Polkadot ETP on SIX Exchange: The Polkadot ETP (PDOT) will list on the Swiss SIX Exchange on Thursday. Switzerland-based investment product provider 21Shares is launching the world’s first exchange traded product (ETP) for the Polkadot cryptocurrency. The firm said the listing came about because it wanted to stay "ahead of the curve" amid a surge in interest for the cryptocurrency asset class. Founded by Ethereum co-founder Gavin Wood, Polkadot is a blockchain network that supports various interconnected sub-chains called parachains. Last Friday, Polkadot was added to the 21Shares HODL basket ETP as the second-largest constituent after bitcoin, replacing bitcoin cash. As such, 21shares took the decision to give the crypto asset its own ETP. Read More.

Kraken Exchange Brings Its Spot Price Data to DeFi Via New Chainlink Node: Kraken, the fourth-largest cryptocurrency exchange by trading volume, is making its spot price data available for use by decentralized finance (DeFi) applications and developers. Kraken announced Monday it is now running its own Chainlink node, enabling it to broadcast its Oracle Rates to Ethereum and other blockchains. Chainlink’s built-in cryptographic signing capability also means users will have access to on-chain proof of any data originating from Kraken's platform. The Oracle Rates can provide real-time price data feeds for decentralized applications, including derivatives contracts, lending, payments and stablecoins, San Francisco-based Kraken said. Chainlink's decentralized oracle network is widely used within DeFi to provide reliable price data aimed to be free from manipulation. Oracles provide data that can be used to trigger events using smart contracts. Read More.

“Not only will this provide DeFi with accurate price feeds from a high-volume exchange, but we can cryptographically sign this data on-chain to prove without a doubt its origin, making it even more reliable when used to trigger automated blockchain transactions,” said Jeremy Welch, Kraken’s VP of product.

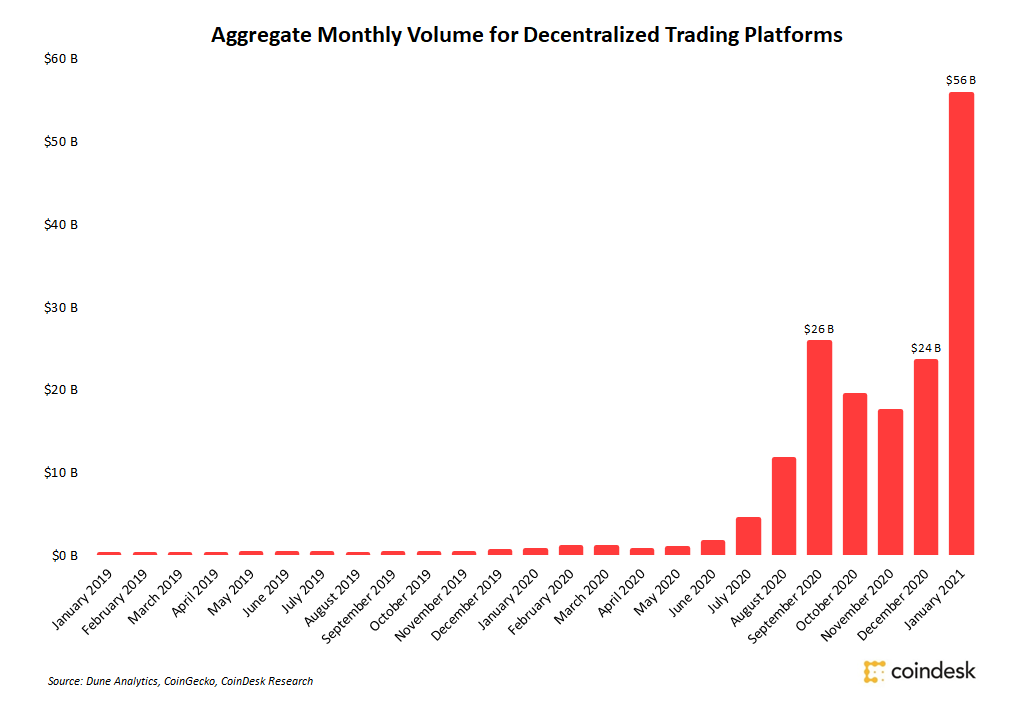

Decentralized Exchange Volumes Hit Record Above $50B in January: Uniswap represented over 45% of total DEX volume. January trading volume on decentralized exchanges soared to set an all-time high above $50 billion, eclipsing the previous record of $26 billion from September 2020 by a wide margin, according to data from Dune Analytics. Uniswap represented over 45% of total volume in this category of exchanges, with $25.9 billion traded in January. Noted Uniswap rival Sushiswap claimed nearly 22% of total volume, with $12.2 billion last month. Read More.

Media

The Bitcoin Supercycle with Dan Held

334 TIP. Disruptive Innovation w/ Cathie Wood

ETHEREUM RUNNING FOR ATH RIGHT NOW!!!! PREPARE FOR ALTSEASON OF THE GODS!!!

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.