Crypto Download #53

Caution: Frothy Volatile Markets; Fed & Monetary Authorities Signal Continued Support for Damaged Global Economy; Miami Hosts Bitcoin Whitepaper on Website; Grayscale Entering DeFi Space; FB's DIEM

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

ICYMI

Macro

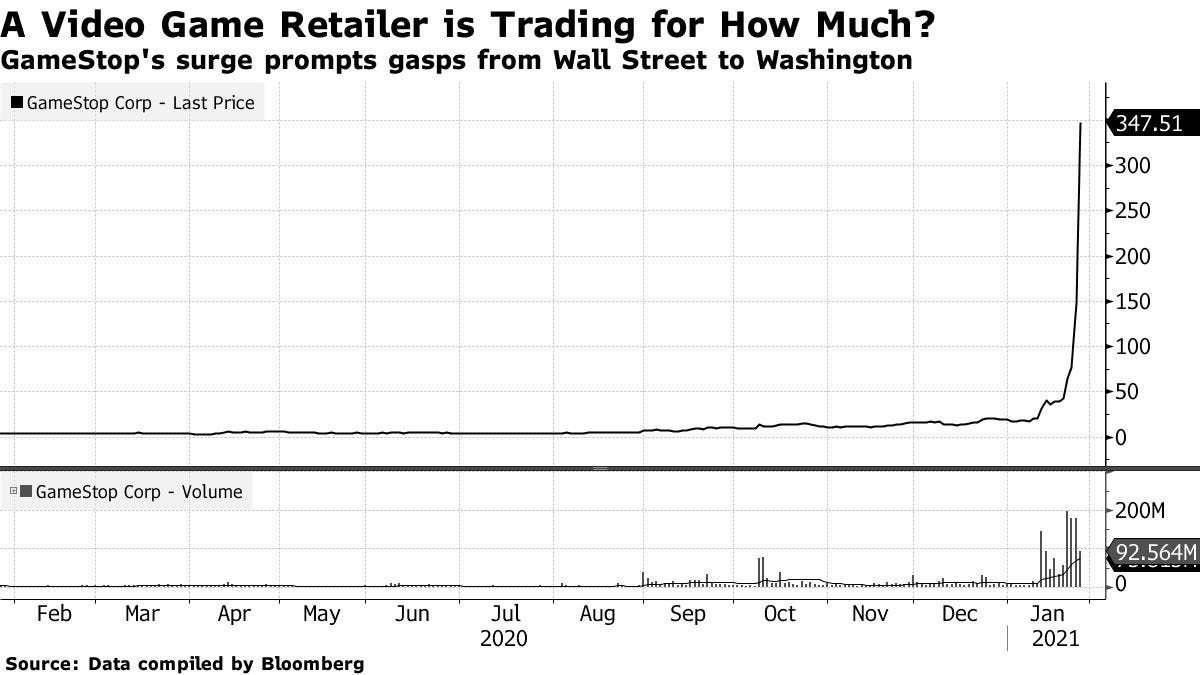

Gensler Is Poised to Confront Stock Market Hit by Historic Mania: From the mania engulfing GameStop Corp. and penny stocks to the explosive growth of SPACs, a nervous question is starting to make the rounds within American finance: Will the next sheriff of Wall Street be able to tame these wild markets? Gary Gensler, President Joe Biden’s pick to lead the Securities and Exchange Commission, is poised to confront a run-up in share prices with few parallels in modern history. Perhaps more worrisome, the astronomical valuations are tied to companies like GameStop that aren’t expected to turn a profit for years, or, in the case of special-purpose acquisition companies, stocks with no actual business behind them. The looming threat for Gensler, 63, is that the good times could end on his watch, triggering a crash that hits retail investors who’ve contributed to the boom particularly hard. That wouldn’t just create a big problem for the incoming SEC chief, but also for Federal Reserve Chairman Jerome Powell, Treasury Secretary Janet Yellen and the Biden administration. Read More.

“We’re in a bubble, and bubbles burst,” said Jill Fisch, a professor at the University of Pennsylvania’s law school who focuses on market regulation. “For the SEC, that’s a tough thing because investors lose a lot of money. The question is how do you regulate when you know there’s a bubble?”

Stock Fears Come Back With VIX Trading Near November High: Stock volatility is making a comeback amid worries about tech profits, unhinged retail trading and tepid economic growth. The Cboe Volatility Index, known as the VIX, jumped to 37 on Wednesday -- the biggest one-day move since the pandemic-spurred market crash in March. The gauge was trading at 31 as of 7:24 a.m. New York time on Thursday, near the highest since November. The bulk of yesterday’s gain came in after-hours trading, when Tesla Inc., Apple Inc. and Facebook Inc. all fell after reporting results. The futures curve of the VIX, which measures the 30-day implied volatility of the S&P 500 Index, flipped to “backwardation” -- indicating investors expect more volatility in the near-term. Read More.

“For the last two weeks, vol was extremely strong and would not break down on days where the market was doing well,“ said Kris Sidial of hedge fund Ambrus Group.

Central Banks & Monetary Authorities

Fed’s Powell More Worried by Cool Economy Than Hot Markets

“We have not won this yet,” he told a press conference on Wednesday, after the Fed voted to keep short-term interest rates pegged near zero. “We’re a long way from a full recovery…We’re going to be patient” and not pull back on support for the economy on the first sign of stepped-up price pressures…Even after the economy fully reopens, I think we are still going to need to keep people in mind whose lives have been disrupted because they’ve lost the work that they did,” Powell said. “It would be wise for the longer run productive capacity of the country if we were to look out for those people and help them find their way back into the labor force even if means continuing support for an additional period of time.”

IMF says fiscal support needed until recovery takes hold

Global debt likely reached 98% of economic output at the end of 2020 as governments poured in nearly $14 trillion in fiscal support to battle the coronavirus pandemic, the International Monetary Fund said on Thursday, urging that fiscal support stay in place until recovery is firmly underway.

“Global cooperation on producing and widely distributing treatments and vaccines to all countries at low cost is crucial,” IMF officials said in a blog posting accompanying the report. “Vaccination is a global public good that saves lives and will eventually save taxpayers’ money in all countries. The sooner the global pandemic ends, the quicker economies can return to normal and people will need less government support.”

Powell Says No Bond Taper for ‘Some Time’ as Recovery Moderates

Federal Reserve Chair Jerome Powell made clear the U.S. central bank was nowhere near exiting massive support for the economy during the ongoing coronavirus pandemic, as officials left their benchmark interest rate unchanged near zero and flagged a moderating U.S. recovery.

The central bank’s policy-making body repeated it would maintain its bond-buying program at the current pace of $120 billion of purchases per month until “substantial further progress” toward its employment and inflation goals has been made. It made no changes to the composition of purchases.

Nine banks ate into capital buffers under ECB’s pandemic relief

Nine eurozone banks took advantage of the European Central Bank’s relaxed rules to fall below its minimum capital requirements last year as part of supervisory efforts to keep credit flowing during the coronavirus crisis. The number of banks falling below the ECB’s overall capital requirements and guidance increased from six the previous year, the central bank said on Thursday. While the ECB did not name the banks, it warned that the pandemic was still likely to create more problems for lenders. Andrea Enria, head of supervision at the ECB, said he expected more banks would need to benefit from its exceptional capital relief once the fallout from the pandemic causes an expected increase in bad loans.

“Data for the third quarter of 2020 confirm a concern we already flagged in December,” said Mr. Enria as he presented the ECB’s annual assessment of bank capital. “The way in which banks are preparing for asset quality deterioration varies widely and could, in some cases, be insufficient.

Bitcoin

Blockstream Buys $25M Worth of Bitcoin Mining Machines From MicroBT: Bitcoin technology company Blockstream said it bought $25 million worth of mining machines from MicroBT to expand its mining operations. The machines are to be deployed through Blockstream's facilities in Canada and the US. When the company expects to receive its ASICs was not specified. n 2019, Blockstream launched Blockstream Pool and announced that it had been previously mining for a select few high-profile clients like Fidelity. Read More.

Blockstream has over 300 megawatts in mining capacity available, said CEO Adam Back in a statement. "We'll continue to grow aggressively throughout the year," he said.

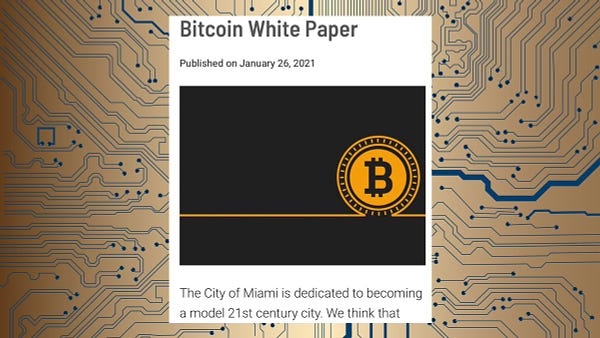

Miami Uploads Bitcoin White Paper to Municipal Website: The city of Miami on Wednesday uploaded a copy of the Bitcoin white paper to its municipal website, joining a growing chorus of governments and companies now hosting bitcoin’s original blueprint. Mayor Francis Suarez emphasized his commitment to "turn Miami into a hub for crypto innovation" in his tweet announcing the upload. He's been pumping the U.S. city's potential as a landing ground for California tech expats for weeks on social media. Read More.

Bitcoin-based DeFi protocol Sovryn raises $2.5 million in a token pre-sale: Sovryn is a bitcoin-based smart contract protocol that offers swaps, lending, leveraged trading, and market-making. "The system runs on the Rootstock (RSK) sidechain, which is merge-mined with Bitcoin," Yago explained. "This means that it is secured by Bitcoin proof-of-work and bitcoin is the native asset (the asset in which all fees are paid)." Sovryn said the pre-sale was reserved for its community, which allowed participants to secure their right to purchase SOV, the protocol's native token. SOV is launching next month, said Sovryn. Participants, however, have the right to cancel the pre-reservation, Sovryn co-founder Edan Yago told The Block, adding that but "none have indicated to do so." Their funds will be locked up for ten months, as part of their "long-term commitment to the project," said Sovryn. The raised capital is primarily earmarked for further developing the Sovryn protocol, its security, and a bug bounty program, Yago told The Block. Still, the community governance would decide how to utilize it, he said. Read More.

Crypto

Facebook's Diem Testnet Hits 50 Million Transactions: The testnet for Diem, the Facebook-backed stablecoin project, reached over 50 million transactions yesterday, data from blockchain explorer inDiem shows. The development comes a little over a month after Diem was rebranded from the erstwhile “Libra” project. Diem is a stablecoin—a type of cryptocurrency pegged on a 1:1 basis with fiat currencies, the US dollar in this case—aiming to disrupt the traditional payments market with its low-fee, scalable, and fast settlement features. It is run by the Diem Association and a consortium of other members, such as crypto exchange Coinbase and ride-sharing giant Uber. Read More.

Digital Asset Manager Grayscale Eyes DeFi Space With New Trust Filings: Grayscale Investments, the world’s largest digital asset manager, has filed to register five new trusts for cryptocurrency assets, several being connected to the decentralized finance (DeFi) space. All filed on Jan. 27, the Delaware corporate registry now lists trusts for Aave (AAVE), Cosmos (ATOM) and Polkadot (DOT), as well as privacy coin Monero (XMR) and Cardano (ADA). Grayscale has registered trusts for Chainlink (LINK), Basic Attention Token (BAT), Decentraland (MANA), Livepeer (LPT), Tezos (XTZ) and Filecoin (FIL) in the last few months. Read More.

Reddit Joins With Ethereum Foundation to Build Scaling Tools: Reddit is growing its role in the Ethereum ecosystem, with the goal of building out scaling tools for the blockchain network. The social media platform announced Wednesday it was expanding its work with the Ethereum Foundation to provide development resources to scaling tools. In the announcement, posted to the Ethereum subreddit, Reddit employee u/jarins said the move increases its commitment to the technology, and echoes its long-held “decentralized ethos.” Read More.

“In this new stage of our partnership, immediate efforts will be focused on bringing Ethereum to Reddit-scale production,” the announcement said. “Our intention is to help accelerate the progress being made on scaling and develop the technology needed to launch large-scale applications like Community Points on Ethereum.”

WallStreetBets Telegram Group Gets 40,000 Members in 24 Hours: An unofficial Telegram channel set up to support the WallStreetBets movement has grown by 40,000 members in just 24 hours—and it’s climbing rapidly. Reddit’s WallStreetBets subreddit broke into mainstream news over the past few days after it encouraged its community to buy the stock of video game company GameSpot. The redditors’ aim was to liquidate the short trades that many investment firms had in place (which largely worked). But this massive market movement has brought a lot of attention to the notorious subreddit. Already WallStreetBet’s Discord channel has been banned over “hate speech” and its subreddit has already gone down temporarily. And some in the community are concerned that it needs a more secure footing. Read More.

“I figured eventually censorship would be too great on reddit and discord. Seems I was correct about that,” said the owner of this specific WallStreetBets Telegram channel (there are many), who goes by the pseudonym BTCVIX.

Media

BTC010: Bitcoin & Layered Money w/ Nik Bhatia

NFT & Crypto Gaming 2021 Predictions & Forecast

MacroVoices #255 Mike Green: Bitcoin’s Role in the Future of Digital Currency

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.