Crypto Download #52

ECB Warns Banks of Pandemic Insolvency Wave; Governments Coordinate Against Big Tech; Harvard & Other Endowments Invest in Bitcoin; More Companies to Put BTC on Balance Sheets; Don't Sleep on ETH

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

ECB Steps Up Scrutiny of Bank Risk Before Potential Default Wave: The European Central Bank is stepping up its scrutiny of credit risk at banks across the continent to get a better sense of their preparation for a potential wave of loan defaults triggered by the pandemic. Officials from the ECB and national watchdogs are pushing banks including BNP Paribas SA, Societe Generale SA and Deutsche Bank AG for additional information on their corporate lending in 2020. It’s part of an effort to ensure that lenders can withstand a possible surge of defaults. ECB Supervisory Board Chairman Andrea Enria has repeatedly warned that the pandemic may cause non-performing loans at banks to soar once government relief programs run out, and he urged lenders to brace for that scenario. Read More.

Merkel hopes to step up work on digital tax with Biden administration: German Chancellor Angela Merkel said on Tuesday she hoped to intensify work with the U.S. President Joe Biden’s new administration on minimum taxation of digital companies. The Organisation for Economic Cooperation and Development outlined last year the first major rewriting in a generation of international rules for taxing cross-border businesses like Google, Apple and Facebook. Read More

“I hope that with the new American administration we can now continue and intensify the work of the OECD on the minimum taxation of digital companies,” Merkel told this week’s World Economic Forum event by video conference. She added that she hoped “that we will succeed in once again anchoring the central role of competition law globally and preventing the emergence of monopolies.”

China, New Zealand ink trade deal as Beijing calls for reduced global barriers: China and New Zealand signed a deal on Tuesday upgrading a free trade pact to give exports from the Pacific nation greater access to the world’s second-largest economy. The pact comes as Beijing seeks to establish itself as a strong advocate of multilateralism after a bruising trade war with the United States, at a time when the coronavirus has forced the closure of many international borders. The previous day, speaking at a virtual meeting of the World Economic Forum, President Xi Jinping had criticized isolationism and “Cold War” thinking and called for barriers to trade, investment and technological exchange to be removed. In recent months, Beijing has signed an investment pact with the European Union and joined the world’s largest free trade bloc in the 15-country Regional Comprehensive Economic Partnership (RCEP), which includes New Zealand. Read More.

“The upgrade shows the two sides’ firm determination to support multilateralism and free trade,” Zhao Lijian, a spokesman of China’s foreign ministry, told a news briefing in Beijing on Tuesday.

Marathon Raises $900 Million for Asset-Based Loans as Banks Flee: Distressed-debt titan Marathon Asset Management has raised $900 million for extending asset-backed loans to companies that may be struggling to find financing, as a pullback from major lenders has allowed alternative asset managers to step in. The firm will invest in loans in health care, real estate, equipment and transportation, as well as corporate sectors backed by contractual cash flows. Collateral may include intellectual property rights and royalties from FDA approved drugs and medical devices, as well as aircraft, real estate and structured consumer loans. Read More.

“As certain borrowers and legacy asset owners continue to have limited access to efficient markets, we have a compelling opportunity to provide innovative capital solutions through loans backed by strategic, mission-critical assets across a range of sectors,” Cong said.

How a Penny Stock Explodes From Obscurity to 451% Gains Via Chat Forums: In some nine hours, financial markets would open in New York, and when they did, an obscure penny stock by the name of Blue Sphere Corp. would suddenly, and seemingly miraculously, soar, handing a windfall of some $30 million to those who had loaded up on the stock in the weeks before. TRGainz and Alwaysliquid knew what was coming and were struggling to contain their excitement. For days, chatter on this Stocktwits page and others, like a message board for Reddit users dedicated to penny stocks, had been steadily building about Blue Sphere. That the company had neither a stock exchange listing nor recent financial disclosures of any kind seemed not to matter to anyone. It was a clean-energy company and, with the Democrats taking control of both the White House and Congress, that was enough to make it a sellable story to the day-trading masses who had turned into an unstoppable force in the great pandemic stock rally. Read More.

China Central Bank Won’t Exit Prematurely From Stimulus: China’s central bank won’t exit “prematurely” from its supportive monetary policies while at the same time keeping debt risks under control, Governor Yi Gang said. Monetary policy will continue to “prop up the economy,” Yi said on a panel hosted by the World Economic Forum Tuesday. Officials will remain mindful of risks, such as a rising macro leverage ratio and higher non-performing loans. However, financial markets were roiled Tuesday after the central bank withdrew cash from the banking system and an adviser to the People’s Bank of China warned about asset bubbles. The PBOC drained about $12 billion of liquidity, an unusual move so close to the Lunar New Year holiday in February. Read More.

Bitcoin

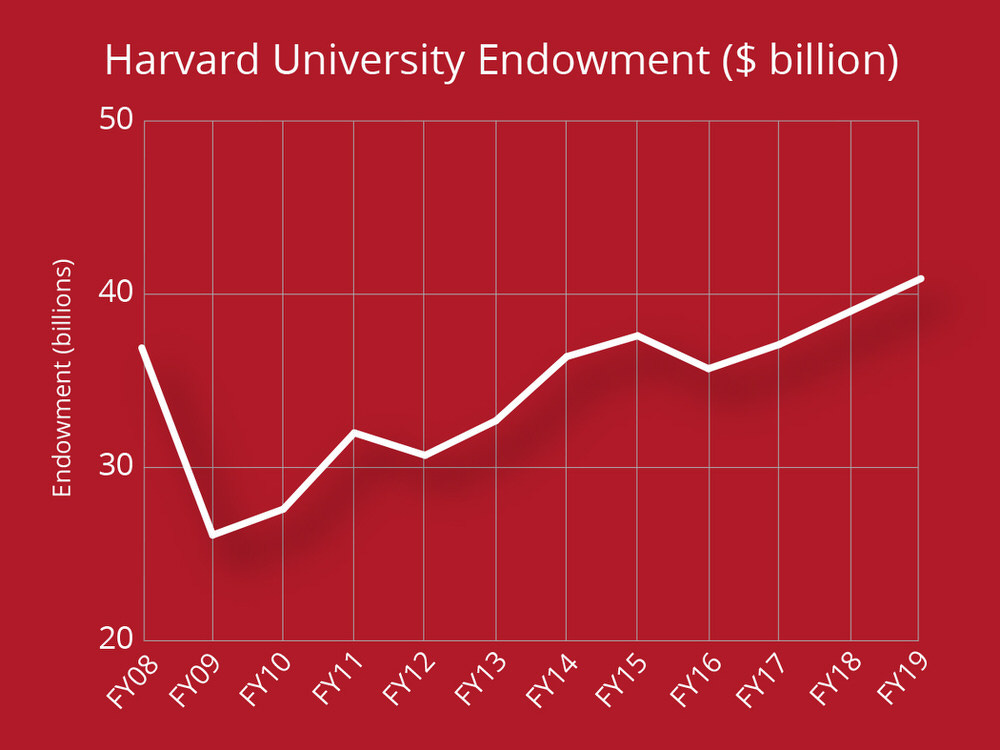

Harvard and Yale Endowments Among Those Reportedly Buying Crypto: Harvard University, Yale University, Brown University and the University of Michigan are among schools whose multibillion-dollar endowments have begun buying cryptocurrency directly on exchanges. A lot of endowments are allocating a small portion to crypto, and most have been in for at least a year. Coinbase, the biggest cryptocurrency exchange in the U.S., mentioned endowments as among clients who have been investing in crypto. Rising institutional adoption has been one of crypto’s biggest stories in the past year. Bitcoin, rose fourfold in 2020 and has gained even more to start this year. Big investors like Guggenheim Partners LLC and Paul Tudor Jones have touted it, helping raise interest and set a precedent. And it’s been increasingly mentioned as a diversifier in asset allocations, a sort of “digital gold.” Read More.

“While 2020’s unusual macroeconomic environment has accelerated crypto adoption, importantly, many clients who allocated this year — particularly endowments, corporates and other long-term investors — do not believe the present market dynamics are required for Bitcoin’s success,” Coinbase said in its report. “They intend to hold Bitcoin as part of their core portfolio over the long term, throughout varying market conditions.”

Cathie Wood: More Tech Companies Will Adopt Bitcoin Treasury Reserves: ARK Investment Management CEO Cathie Wood said she believes more companies will load their balance sheets up with bitcoin. In a Saturday interview with Yahoo Finance, Wood said large companies have asked her if they should follow Square. Inc’s lead. Square is one of the few public companies to invest in bitcoin as an inflation hedging strategy. Read More.

“I think we’re going to hear about more companies putting this hedge on their balance sheet,” she said, “particularly tech companies who understand the technology and are comfortable with it”.

Crypto Miner Marathon Patent Group Buys $150M in Bitcoin: Cryptocurrency mining company Marathon Patent Group (MARA) bought $150 million in bitcoin for around $31,100 apiece during the crypto asset’s recent price rout. The Nasdaq-listed firm said Monday it purchased the cryptocurrency through institutional bitcoin shop NYDIG. Marathon is the latest publicly traded company to swap a cash treasury for bitcoin, and, with 4,812.66 BTC now on the books, one of the largest by sheer investment size. Marathon CEO Merrick Okamoto said in a statement the bitcoin buy “accelerates” his mining company’s transformation into a “pure-play bitcoin investment option” for crypto-hungry Wall Street traders. Read More.

Bitcoin, crypto inflows hit record last week: Investment flows into cryptocurrency funds and products hit a record $1.31 billion last week after a few weeks of small outflows, as investors took advantage of the decline in bitcoin and other digital asset prices, according to the latest data on Monday from asset manager CoinShares. Read More.

“The recent price weakness, prompted by recent comments from Secretary of the U.S. Treasury Janet Yellen and the unfounded concerns of a double spend, now look to have been a buying opportunity with inflows breaking all-time weekly inflows,” he added.

Crypto

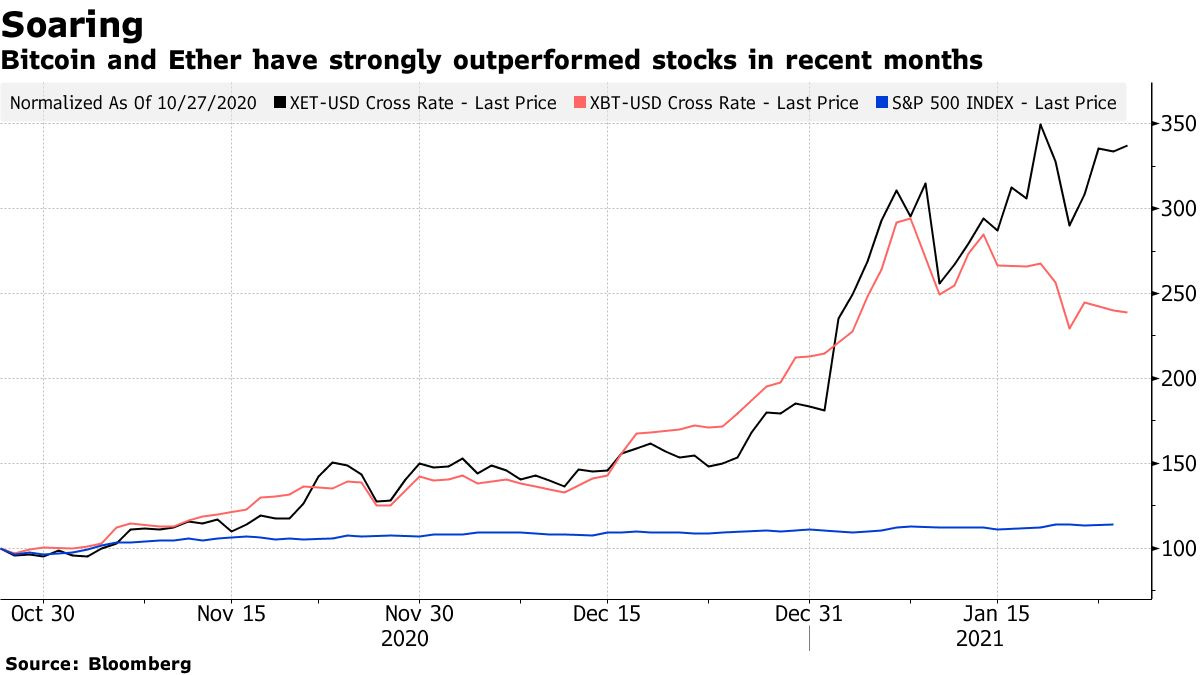

More Institutional Investors Are Buying Ether, Seeing It as a Store of Value: Ether’s latest rally to all-time highs appears to be driven, in part, by the sort of institutional investors who piled into bitcoin in 2020 for its digital gold narrative. More institutional investors are seeing ether as a store of value. The crypto exchange noticed “a growing number” of its institutional clients have taken positions in ether, the native currency of the Ethereum network, for its strong returns. These clients predominantly bought bitcoin in 2020. Read More.

“The case for owning Ethereum we hear most frequently from our clients is a combination of, first, its evolving potential as a store of value and, second, its status as a digital commodity that is required to power transactions on its network…I think the more adventurous institutions are exploring Ethereum and DeFi after they looked at bitcoin,” Arthur Cheong, founder and portfolio manager at DeFi-focused crypto fund DeFiance Capital.

How Joe Biden's Picks for SEC, Treasury Will Impact Crypto: Following Biden’s inauguration, there will be an array of new faces in Washington, including several who will have oversight of the crypto markets, including Gary Gensler and Janet Yellen. Gary Gensler has been picked to lead the SEC. This regulator steps in when it deems coins are securities, fining crypto projects including Telegram, Kik, Enigma, and BitClave—and, last month, serving a lawsuit against Ripple. And yesterday, Janet Yellen was sworn in as the new Treasury Secretary, where she will have a pivotal role in shaping the economic development of the US. The good news is that the 63-year-old Wall Street veteran is quite familiar with the digital assets space, having taught a course at the Massachusetts Institute of Technology (MIT) about how Bitcoin and blockchain could be used in finance. He also authored an op-ed for Coindesk, describing cryptocurrency as a “catalyst for change,” and discussed the need to bring the Federal Reserve into the modern payments era. Read More.

Ethereum NFTs Are Getting Merged With Augmented Reality: Crypto gaming firm Enjin has partnered with augmented reality platform MetaverseMe to create non-fungible tokens (NFTs) in the form of “hyper-realistic avatars.” Starting from February 23, users of the MetaverseMe app will be able to take real-world selfies and generate digital avatars. They can later bring those avatars to life by recording them in augmented reality and sharing the videos via social media. Users will be able to bring these scarce NFTs into other virtual worlds including Minecraft and The Six Dragons, as well as the next version of KickOff Evolution. Read More.

“It won’t be long before the blockchain is recognized as the defacto standard for sharing assets across the Metaverse. Being able to truly own assets and take them and use them in your favourite games, across genres and gaming styles is going to revolutionize the digital economy and gaming,” said Martyn Hughes, CEO of eBallR Games and creator of MetaverseMe.

Media

Why Bitcoin Now: Michael Saylor on the Best Way for Companies to Buy Bitcoin - Ep.209

SALT Talks: Digital Assets with Mike Novogratz (Galaxy Digital) & Ari Paul (BlockTower Capital)

Grant Williams (4th Turning, Helicopter Money, Pension Bubble, The END GAME)

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.