Crypto Download #51

Another Week of 1M Unemployment Claims; ECB Reconfirms 1.85 trillion Euro Bond Buying Program; BlackRock Entry into Bitcoin Market via Derivatives Market; City of Miami Considers Investing in Bitcoin

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

ICYMI:

Macro

Virus & Vaccines:

Eli Lilly Antibody Cuts Covid-19 Risk Up to 80% in Nursing Home Study

Vaccine Shortage Puts Americans on the Road in Search of Shots

Nigeria Now Expects First Covid-19 Vaccine Doses in February

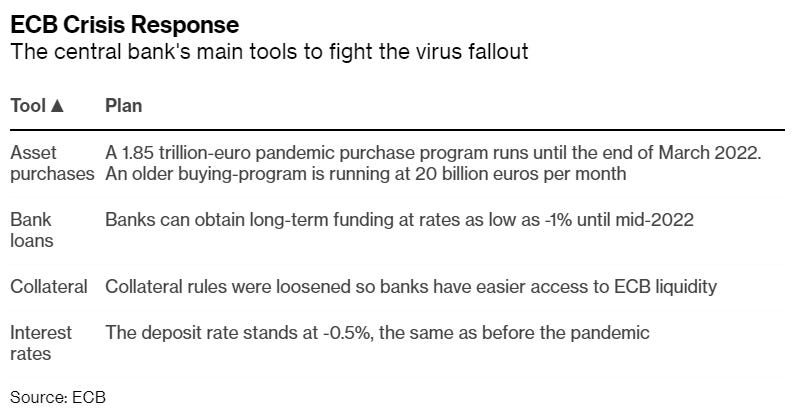

ECB Keeps Stimulus Steady as Economy Grapples With Longer Curbs: The European Central Bank kept its monetary support for the coronavirus-stricken economy unchanged, betting that its recently scaled-up stimulus package is powerful enough to soften the impact of extended lockdowns. President Christine Lagarde and her colleagues held the pandemic bond-buying program at 1.85 trillion euros ($2.25 trillion), after a 500 billion-euro boost last month, and reiterated that it will run until at least March 2022. Read More.

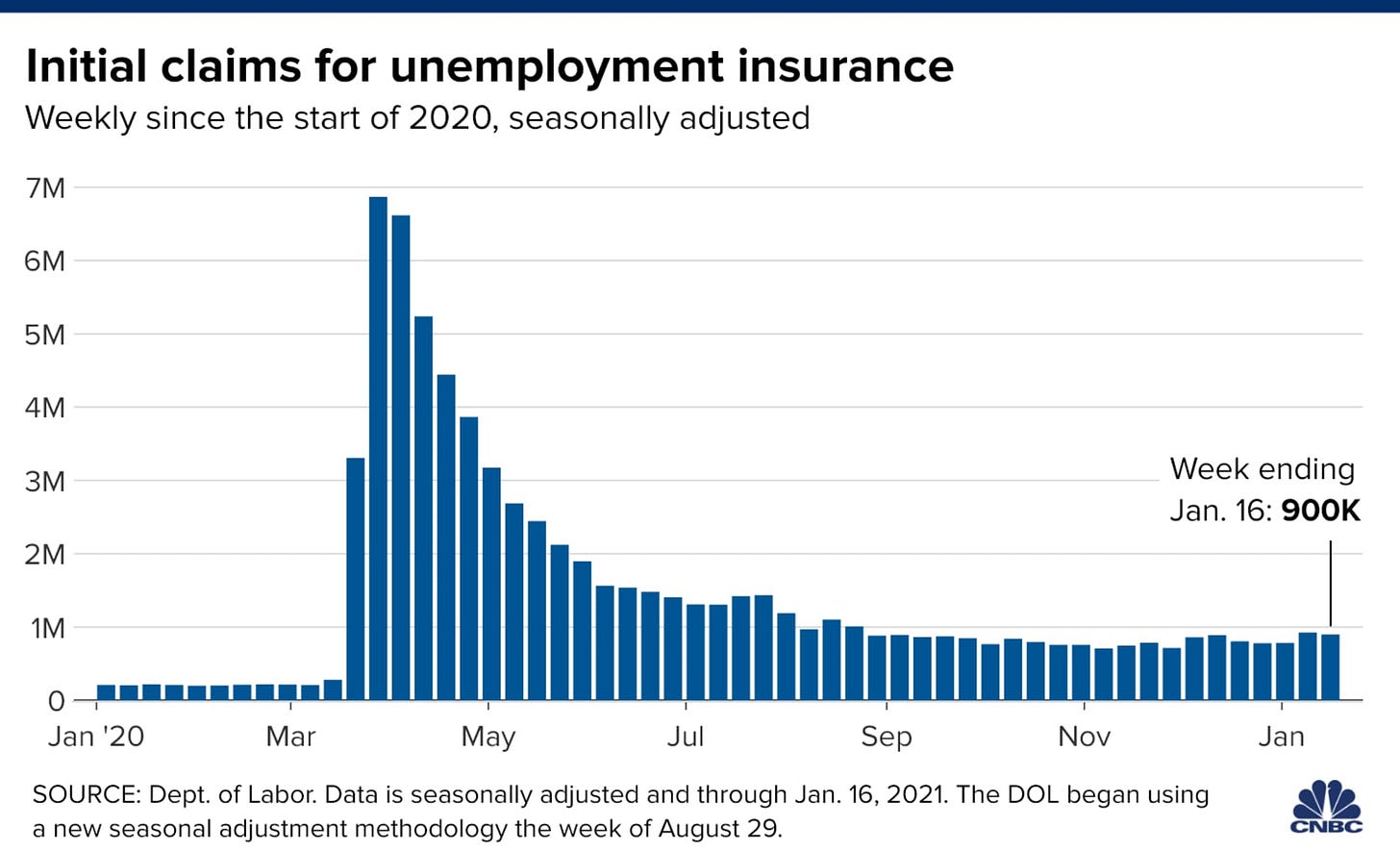

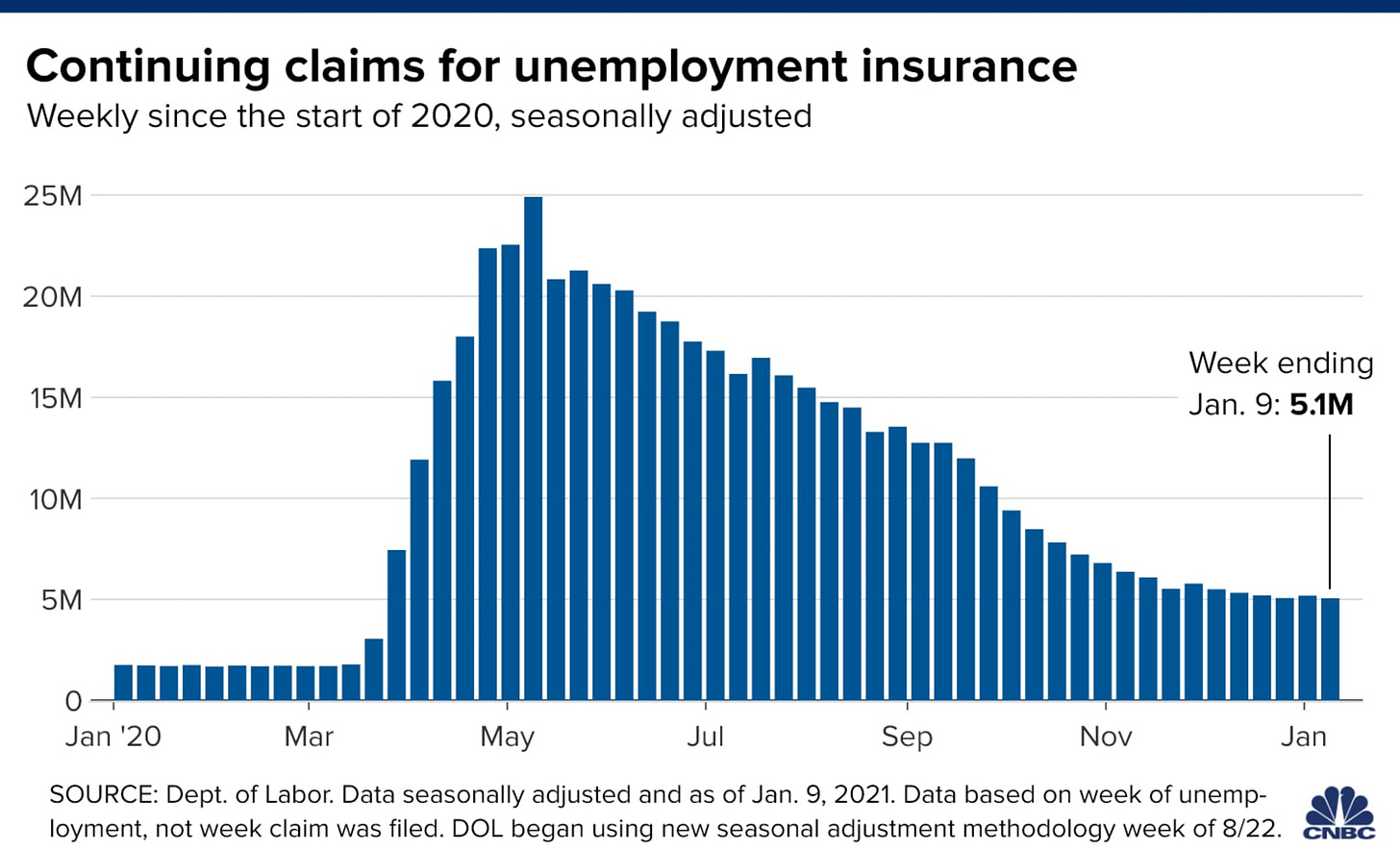

Jobless claims show modest decline as Congress works on more stimulus: Americans continued to hit the unemployment line last week in large numbers as the ongoing surge of Covid cases added to America’s unemployment problem. Jobless claims totaled 900,000 for the week ended Jan. 16, the Labor Department reported Thursday. That was slightly less than the Dow Jones estimate of 925,000 and below the previous week’s downwardly revised total of 926,000. Read More.

Turkish central bank holds rate at 17%, vows tight policy: Turkey’s central bank held rates at 17% as expected on Thursday and promised to tighten more if needed to battle inflation that has soared toward 15%, among the highest in emerging markets, even after sharp hikes in recent months. The lira rallied nearly 1% in response as analysts pointed to hawkish forward guidance that kept the door open to more interest rate hikes. et some predicted another hike given Turks - hammered by soaring food prices - continue to buy hard currencies at record levels. Annual inflation edged up to 14.6% last month, well above an official 5% target. Read More.

Bitcoin

BlackRock Takes First Step Into Crypto Exposure in Two Funds: BlackRock Inc. is adding Bitcoin futures as an eligible investment to two funds, the first time the money manager is offering clients exposure to cryptocurrency. The world’s largest asset manager filed updated prospectuses for a pair of funds including cash-settled Bitcoin futures among assets they’re permitted to buy. Derivatives using cash settlement do not require delivery of the underlying asset. BlackRock, which oversees $8.7 trillion, is signaling a new willingness to test the waters of Bitcoin. Chief Executive Officer Larry Fink said in a 2018 interview that the firm’s clients weren’t interested in owning crypto. But more recently, executives have shown an increased openness to the asset, which is sometimes compared to digital gold. Read More.

The move demonstrates that the asset class is gaining respectability, said Nic Carter, general partner at Castle Island Ventures. “It’s certainly more evidence for the institutionalization thesis that’s really been the theme of this bull market,” he said.

Miami mayor considers bitcoin investment to create crypto hotbed: The mayor of Miami wants to make his city more appealing to Big Tech by embracing bitcoin and even investing some government funds in the cryptocurrency. The mayor told host Stuart Varney that Miami is looking into allowing citizens to pay taxes and fees to the city in bitcoin. Read More.

“We want to be one of the most crypto-forward and technological cities in the country,” he said. “So we're looking at … creating a regulatory framework that makes us the easiest place in the United States to do business if you're doing it in cryptocurrencies….Suarez said bitcoin is “a very attractive investment” and that the city of Miami is considering “diversifying our investment portfolio” and holding a percentage of investments in bitcoin.

BlockFi Adds Bitcoin Trading Desk for Big Investors: BlockFi, a provider of crypto financial services, has launched an over-the-counter (OTC) trading desk for institutional investors. According to the announcement, dedicated traders on BlockFi’s OTC desk will be located in the US and Asia, providing global support to institutional and ultra-high net worth clients. Read More.

Silvergate Took Nearly $3B in Deposits From Digital Currency Customers in Q4 2020: Silvergate Bank accepted a whopping $2.9 billion in new deposits from new and existing digital currency customers in the fourth quarter 2020, according to an earnings report released on Wednesday. The majority of these new deposits came from crypto exchanges which deposited $1.7 billion more in cash to their accounts quarter-on-quarter. Institutional investor deposits grew by $961 million and those from other customers by $234 million. The La Jolla, California-based bank added 41 digital currency customers for a total of 969. The Silvergate Exchange Network, a fiat on-ramp for bitcoin markets, processed 90,763 transactions transferring $59.2 billion over the network during the last quarter. Read More.

“Looking ahead to 2021, I am extremely excited about the multiple paths to continued growth and opportunities to monetize the SEN platform, such as digital asset lending and custodial services,” Silvergate CEO Alan Lane said in a press release. “In particular, SEN Leverage, a lending offering that was piloted through the majority of the past year, is now a core Silvergate product that enables customers to obtain U.S. dollar loans collateralized by bitcoin. We anticipate increased demand for this offering over the next year.”

Sequoia Is Letting its Employees Get Paid in Bitcoin: Software company Sequoia is now letting its employees get paid in Bitcoin. It will also let them get paid in Bitcoin Cash or Ethereum if they so wish. Read More.

"We're excited to offer the members of our team this new benefit," said T. Richard Stroupe, Jr., co-founder and CEO of Sequoia. "Many of our employees are enthusiastic supporters of cryptocurrency, and we're happy to help them gain exposure to this trillion-dollar asset class."

Crypto

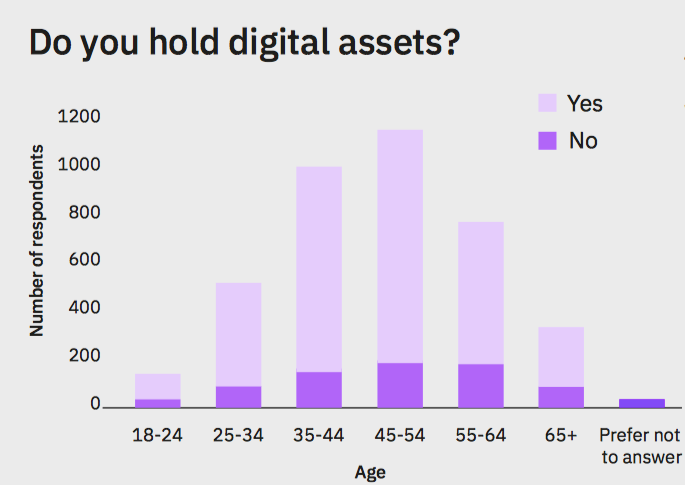

Older investors are getting into crypto, new survey finds: On Jan. 21, digital payment platform Wirex released a special report devoted to the topic of cryptocurrency adoption in 2021. Compiled in partnership with the Stellar Development Foundation, the report includes survey results from 3,834 people across 89 countries, aiming to understand the latest trends in the global adoption of blockchain-powered digital payments. According to the survey results, more than 30% of respondents between the ages of 45 and 54 — the largest survey’s age group — were using crypto. The study also found that 26% of women aged from 55 to 64 invested in crypto, compared to 14% of men in the same age group. Read More.

‘Let’s Not Be Bitcoin’: Yearn Finance Considers Minting $200M in New YFI Tokens: The Yearn community is gauging sentiment for increasing the supply by 22%, of a minting of 6,666 additional YFI (worth something like $200 million, at current prices), a third of which would go to core contributors and the rest would go to the treasury. The proposal, authored by 11 different people, views “the fair launch as a living concept rather than a single event,” they write. Last September, Joel Monegro of Placeholder wrote a blog post urging communities to consider a “buyback-and-make” approach to using platform profits, rather than “buyback-and-burn.” Taking this to heart, the Yearn community moved forward a Yearn Improvement Proposal called Buyback and Build Yearn, or BABY. It passed with 99% support but less than 10% of YFI voting. BABY would use profits from Yearn to buy YFI on the open market and use it for contributor rewards and other Yearn initiatives . Previously, most of the revenue was distributed to YFI holders who staked for governance, but the returns for doing so were fairly low. Yearn is currently earning around $100,000 per week in fees, and community member Ryan Watkins contended that this could be better reinvested in Yearn itself. Read More.

Kyber Upgrading to Compete With Uniswap for DeFi Traders: Kyber Network is aiming to expand the network of liquidity markets with its Kyber 3.0 upgrade in a bid to compete with other exchanges such as Uniswap. Kyber Network, a DeFi exchange for Ethereum-based tokens, announced today plans for the upgrade to Kyber 3.0. The upgrade, it says, will protect liquidity providers from losing out during price volatility. Kyber is also planning a governance vote on changes that would add greater utility to its native KNC token. Read More.

VP TAKE: It might be a good idea to connect your digital wallet to Kyber and execute a trade. We can see Kyber distributing their governance tokens to users for free, similar to DEX Uniswap and DEX aggregator 1inch.

Rick & Morty Creator Sells Ethereum Art for $1.65 Million: Justin Roiland’s first foray into the non-fungible token (NFT) art scene ended up with a bang as his debut crypto art collection was sold for roughly $1.65 million in total yesterday, according to metrics platform CryptoArt.io. Read More.

Media

BTC009: Bitcoin Engineering w/ Core Developer Jimmy Song

SALT Talks: Lyn Alden | Founder, Lyn Alden Investment Strategy

Inflationary Pressure & The Incoming Commodity Supercycle (w/ Simon White and Tian Yang)

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.