Crypto Download #50

Yellen & Biden Administration Tough on Wall Street & The US Dollar; Grayscale Buys $600M of Bitcoin in One Day; Goldman Sachs to Set Up Crypto Custody Play; Ether Price Breaking ATHs

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

Outlook darkens for Wall Street as Biden's regulators take shape: Wall Street may be facing an uncomfortable four years after President-elect Joe Biden’s team confirmed on Monday it planned to nominate two consumer champions to lead top financial agencies, signaling a tougher stance on the industry than many had anticipated. Gary Gensler will serve as chair of the Securities and Exchange Commission (SEC) and Federal Trade Commission member Rohit Chopra will head the Consumer Financial Protection Bureau (CFPB). Progressives see the agencies as critical to advancing policy priorities on climate change and social justice. Read More.

Dollar Shorts Mount Before Yellen Outlines Market-Based Policy: Investors may take Janet Yellen’s expected endorsement of a market-driven exchange rate as an additional green light for the U.S. currency’s long-term downtrend. The U.S. Treasury Secretary-designate will affirm the U.S.’s commitment to a market-determined dollar value on Tuesday. The comments could fuel speculation authorities will not object to a softer greenback, which earlier this month fell to a two-year low against its major peers. Investors are already doubling down on wagers that stand to profit if the currency weakens further, emboldened by an incoming Democratic administration that is prepared to unleash more fiscal stimulus to help the economy recover. The bets come despite a reprieve over the past few weeks that has driven the Bloomberg Dollar Index higher along with Treasury yields. Read More.

“We interpret Yellen’s view to mean the U.S. government is unlikely to stand in the way of an ongoing market-driven dollar depreciation,” said Rodrigo Catril, currency strategist at National Australia Bank Ltd. in Sydney. There’s “no challenge to the current dollar downtrend.”

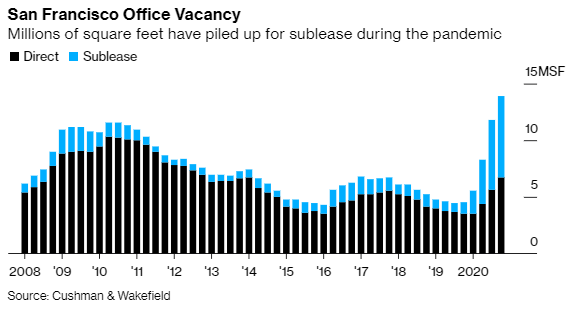

San Francisco Office Vacancy Rate Eclipses Financial-Crisis High: San Francisco’s office market is being hit so hard by the pandemic that, by some measures, it’s worse than the global financial crisis or dot-com collapse. The city’s office-vacancy rate reached 16.7% at the end of 2020, up 11 percentage points from a year prior, according to a report from commercial real estate brokerage Cushman & Wakefield. That’s a higher level than in the aftermath of the 2008 recession. The vacancy rate is being driven by a record amount of sublease space, which has surpassed the worst of the dot-com bust two decades ago, said Robert Sammons, senior director of research at Cushman in San Francisco. In addition, new leasing has effectively been on pause and hit the lowest annual level in 2020 since at least the early 1990s. Read More.

Bitcoin

Institutional Investors Buy $600 Million of Bitcoin in Just One Day: Digital assets manager Grayscale has added 16,244 Bitcoin - currently worth over $600 million - to its Grayscale Bitcoin Trust yesterday. This was the single largest daily purchase so far in both Bitcoin and dollar terms. The transaction was more than 18x of the new daily mined supply of BTC. Although it’s worth noting that the growth of the fund may be either through new purchases of Bitcoin or existing investors moving their holdings to the trust. That said, the fund now looks after a total of 632,000 Bitcoin, worth $24 billion. Read More.

Goldman Sachs to Enter Crypto Market ‘Soon’ With Custody Play: U.S. banking powerhouse Goldman Sachs has issued a request for information (RFI) to explore digital asset custody, according to a source inside the bank. When asked about timing, the Goldman source said the bank’s custody plans would be “evident soon.” Goldman’s digital asset custody RFI was circulated to at least one well-known crypto custody player toward the end 2020. Read More.

“Like JPMorgan, we have issued an RFI looking at digital custody. We are broadly exploring digital custody and deciding what the next step is,” said the Goldman source.

Iran Reportedly Seizes 45K Bitcoin Mining Machines After Closure of Illegal Operations: Authorities in Iran have seized tens of thousands of bitcoin mining machines that they claim have been using illegally subsidized electricity from state-run energy provider Tavanir. The country’s recent blackouts across major cities have been blamed in part on cryptocurrency mining, drawing the ire of officials who have sought a temporary stay on bitcoin mining until further notice. Read More.

PayPal’s Bitcoin revenue expected to top $2 billion by 2023: Global payments giant PayPal is expected to generate more than $2 billion in revenue from its cryptocurrency services over the next two years. If the figure ends up surging to $2 billion, it would equate to 10% of PayPal’s total annual revenue following a shift in momentum towards cryptocurrencies. Read More.

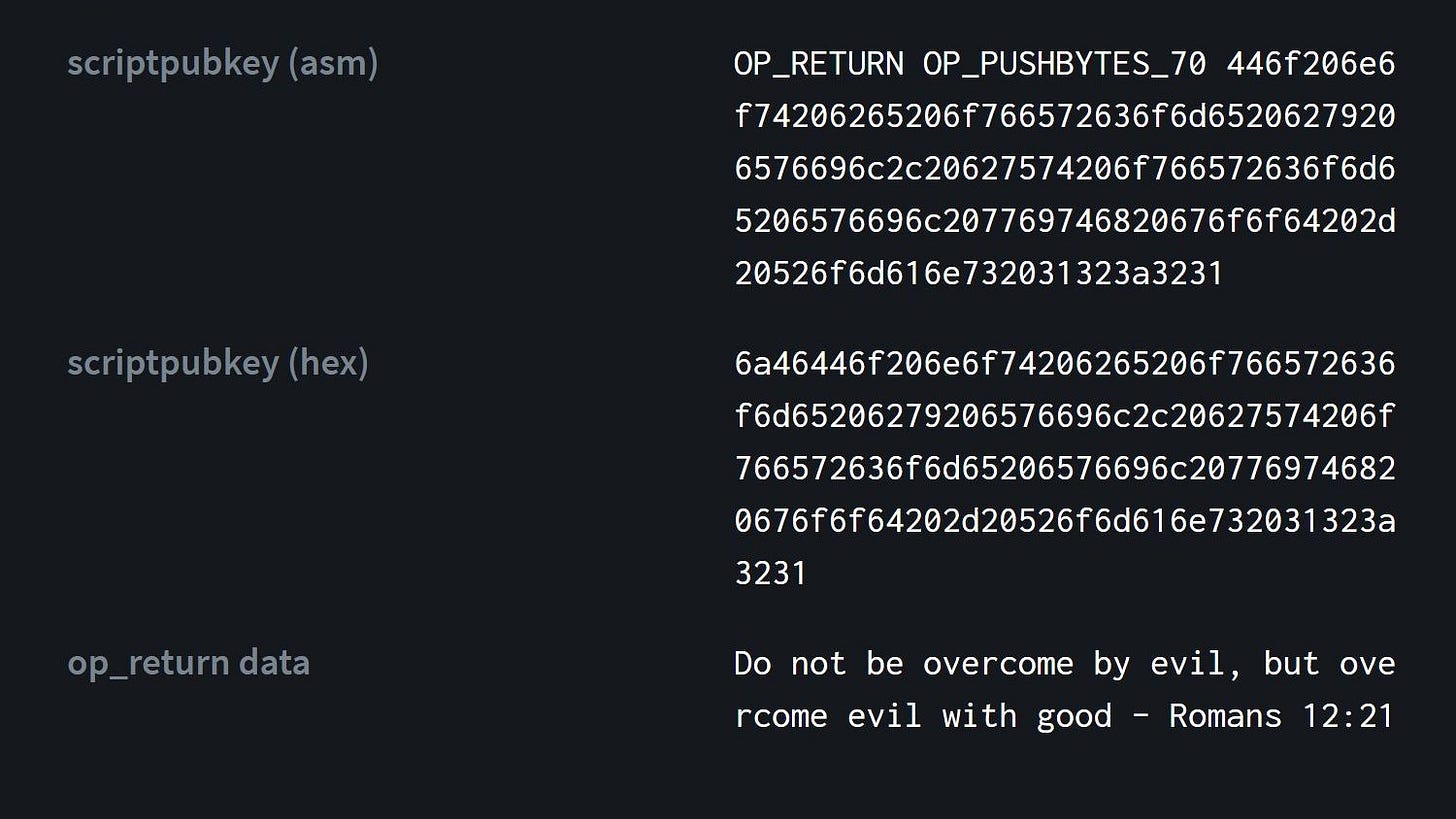

Bible quotation found in Bitcoin block number 666,666: A hidden Biblical message has been found embedded in a transaction in block number 666,666 of the Bitcoin blockchain. Read More.

“Do not be overcome by evil, but overcome evil with good - Romans 12:21.”

Crypto

Ethereum’s Ether Cryptocurrency Sets New Price Record on Major Exchanges: Ether (ETH), the native cryptocurrency of the Ethereum blockchain network, has broken its previous all-time price highs. Prices surged on Tuesday to reach $1,439.33 – that’s over Bitstamp’s recorded high of $1,420. Coinbase and Bitfinex have previous record peaks listed around the same level.

Ethereum is a blockchain for decentralized applications (dapps) such as prediction markets or trading venues. Dapps operate similarly to regular applications, but inherit features of blockchain-based technologies such as censorship resistance. The Ethereum blockchain was co-founded and originally described by Russian-Canadian developer Vitalik Buterin, who remains the project’s most well-known personality. In the long run, Ethereum proponents are positioning the blockchain project to be a censorship-resistant base layer operating in the background of tomorrow’s internet. This concept is generally referred to as Web 3.0, and will knit today’s social networks with integral money systems. Read More.

Nvidia May Restart Production of Crypto Mining GPUs if Demand Sufficient: Chip-making giant Nvidia could potentially restart production of dedicated graphics processing units (GPUs) for cryptocurrency miners, according to its executive vice president and chief financial officer, Colette Kress. Kress said if demand in the cryptocurrency market picks up to a "meaningful" level, the company could again start selling the specialized cards called CMPs. CMPs are GPUs with the video outputs removed, allowing them to be made and sold more cheaply. While bitcoin miners use specialized and more costly processors called ASICs, other cryptocurrencies like Ethereum's ether can be mined with GPUs. Read More.

India’s Largest Crypto Exchange Launches User-Friendly App, Eyes 50M New Users: India’s largest cryptocurrency exchange, CoinDCX, has launched a new app aimed to make it easy to buy and sell bitcoin and other top digital assets in a bid to capture 50 million new users. The app is said to be backed by artificial intelligence-based anti-money laundering algorithms, while users’ funds are secured and insured by global custodian BitGo. Read More.

Media

SALT Talks: Michael Saylor | Chairman of the Board & Chief Executive Officer, MicroStrategy

WATCH: Treasury secretary nominee Janet Yellen testifies at Senate confirmation hearings — 1/19/21

Michael Saylor: The Physics of Bitcoin

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.