Crypto Download #49

Biden Stimulus Plan: $1.5 Trillion; 1M New Unemployment Claims Last Week; Bitcoin Friendly to SEC Chair: Gary Gensler; Exchanges Can't Keep Up with BTC Demand; Too Much Bullish News for BTC & DOT

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Biden to unveil plan to pump $1.5 trillion into pandemic-hit economy: President-elect Joe Biden will unveil a stimulus package proposal on Thursday designed to jump-start the economy during the coronavirus pandemic with an economic lifeline that could exceed $1.5 trillion and help minority communities.

The stimulus package has a price tag above $1.5 trillion and includes a commitment for $1,400 stimulus checks, according to a source familiar with the proposal, and Biden is expected to commit to partner with private companies to increase the number of Americans getting vaccinated. A significant portion of the additional financial resources will be dedicated to minority communities. “I think you will see a real emphasis on these underserved communities, where there is a lot of hard work to do,” said another transition official. Read More.

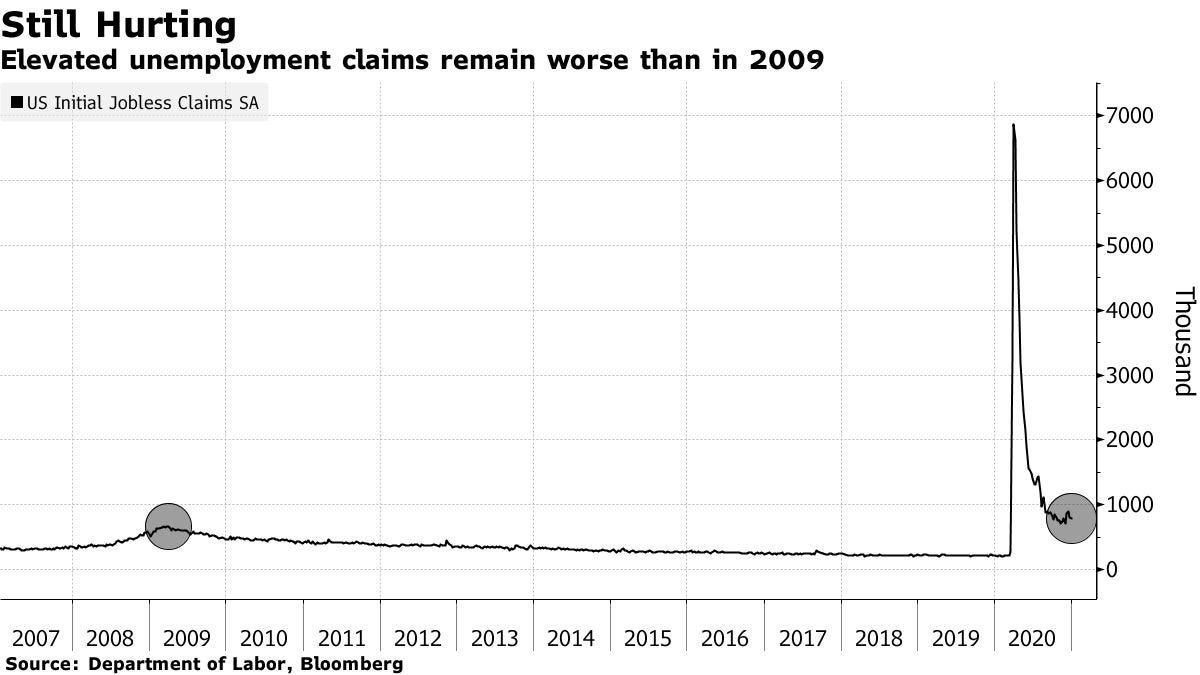

U.S. Jobless Claims Jump by Most Since March, Approach 1 Million: Applications for U.S. state unemployment benefits surged last week by the most since late March, pointing to persistent labor-market pain as coronavirus infections continue to soar. Initial jobless claims in regular state programs rose by 181,000 to 965,000 in the week ended Jan. 9, Labor Department data showed Thursday. On an unadjusted basis, the figure rose to 1.15 million. Read More.

The ECB Is No Longer a Reliable Cash Machine for Governments: Euro-zone monetary policy is subsidizing the finance industry to such a degree that national central banks are having to curtail the cash distributions they normally hand to governments. The sting in the tail of the European Central Bank’s massive pandemic stimulus, in particular its so-called TLTRO program of loans, is that monetary authorities from Estonia to Austria are facing reduced earnings. That means less money feeding into national treasuries. The smaller profits, or even losses, are tangible evidence of how monetary policy is straying into territory more usually occupied by fiscal authorities. The phenomenon is likely to be widespread after the ECB decided last year to sweeten its long-term loans for lenders with interest rates on offer as low as -1%, on condition that they keep credit flowing to the economy. The ECB and its members have been earning less from the subzero rate on the deposit facility ever since late 2019, when they exempted banks from a portion of charges to relieve the strain on their margins. The euro area’s monetary authorities each generate money from operations implementing ECB policies such as quantitative easing. They also get a cut as shareholders in the Frankfurt institution relative to each economy’s size. Read More.

Bitcoin

US President-Elect Biden to Nominate MIT Blockchain Professor Gary Gensler as SEC Chairman: Biden has finally decided on his final pick to lead the SEC, following the stepping down of Jay Clayton as chairman in December. Gensler is a well-known figure in the crypto industry, specifically in the academic sphere. During Trump’s administration, the former Goldman Sachs banker taught courses on crypto assets and blockchain at MIT Sloan School of Management. Sources familiar with the matter told Reuters that Gensler could aim for “tougher regulations,” raising concerns among Wall Street firms. Read More.

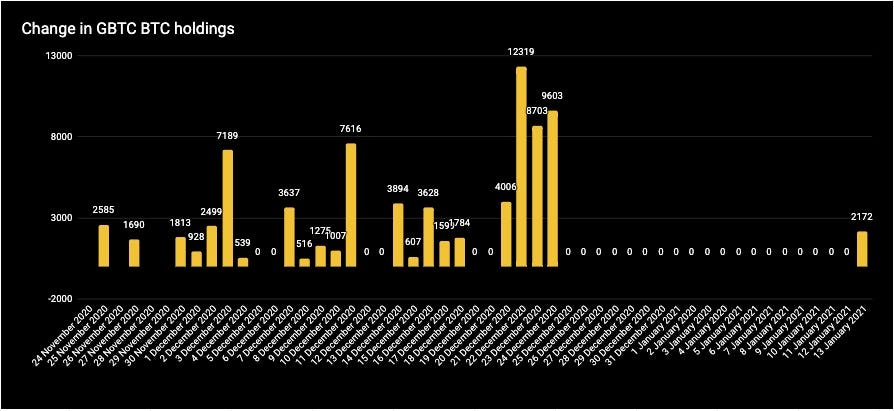

Grayscale Sucks up 2,000 Bitcoin on First Day Back: Digital asset manager Grayscale Investments has added another 2,172 Bitcoin —worth roughly $82.5 million at current prices—to its Bitcoin Trust, noted GBTC Bitcoin Tracker on Twitter today. Read More.

“After a break since the 24th of December, Grayscale’s bitcoin trust is as of yesterday open to new investment. In their first day back they added 2,172 Bitcoin, which equals 2,41X of bitcoin mined,” GBTC Bitcoin Tracker tweeted.

Pantera Capital CEO doubles down on $115K Bitcoin prediction for 2021: Dan Morehead, founder and CEO of Bitcoin investment firm Pantera Capital, has maintained his bullish Bitcoin prediction for 2021. Bitcoin is poised to hit as much as $115,000 by August 2021, surging 200% in the next eight months. Morehead believes that major global digital currency developments like China’s digital yuan will positively impact the crypto market by boosting mainstream adoption. Morehead is not alone in believing that Bitcoin will reach $100,000 in 2021. In early January, Binance.US CEO Catherine Coley predicted that Bitcoin could hit $100,000 by the end of the year. PlanB, the creator of the stock-to-flow model, also predicted that Bitcoin should achieve the $100,000 to $288,000 range by December 2021. Read More.

“Is bitcoin overvalued? I would say no…Bitcoin has spent three years well below its long-term compound annual growth trend line, it’s still below it, and although Bitcoin has rallied a great deal over the last six months, I think it is fairly valued…There are over a billion people on earth that do not have access to a bank, but do have access to a smartphone, and that’s all you need to use a cryptocurrency,” Morehead said.

EToro warns users it's running out of crypto to trade due to 'unprecedented demand': Exchange platform eToro is struggling amid surging demand for crypto, sending an email to all users warning of possible trading limitations this weekend. EToro has become a victim of its own success. Yesterday marketing manager Brad Michelson revealed that in the previous 11 days, 380,000 new users had opened accounts and that trading volumes had surged 25 times higher than the same time in 2020. Read More.

“The unprecedented demand for crypto, coupled with limited liquidity, presents challenges to our ability to support BUY orders over the weekend.”

Bitcoin Mining Comes to the Arctic Circle: The Siberian city of Norilsk is best known as the home of mining giant MMC Norilsk Nickel PJSC. With a population of 180,000, it’s one of the biggest human settlements beyond the Polar Circle and only reachable by plane or boat. The city may soon be famous for a different type of mining though — it now hosts the Arctic’s first crypto farm for producing new Bitcoins. BitCluster, the facility’s Russian owner, is already planning an expansion after starting operations late last year. Read More.

Anchorage Becomes First OCC-Approved National Crypto Bank: Crypto custodian Anchorage has secured conditional approval for a national trust charter from the U.S. Office of the Comptroller of the Currency (OCC), making it the first national “digital asset bank” in the U.S. The safekeeping, management and trading of digital assets have been regulatory stumbling blocks for large financial institutions – but those obstacles are gradually being removed. The OCC, a part of the Treasury Department charged with keeping banks safe but also competitive, has now issued three interpretative letters that lay the groundwork for banks to custody crypto, participate in blockchain networks and become payment providers using the tech. Anchorage’s trust company unit first applied for a national charter from the OCC last November, and it joins Kraken and Avanti in being crypto-native banks, although the latter two are special-purpose depository institutions organized under Wyoming state law. Fellow crypto startups BitPay and Paxos have also applied for federal charters through the OCC. Read More.

“In granting this charter, the OCC applied the same rigorous review and standards applied to all charter applications,” the bank regulator said in a statement. “By bringing this applicant into the federal banking system, the bank and industry will benefit from the OCC’s extensive supervisory experience and expertise.”

“We are a national bank. The only difference is our business line, that we’re doing crypto assets versus doing other assets,” Anchorage President Diogo Mónica said in an interview. “The benefit of having a federally chartered bank is that it preempts all the state laws. The clarity of being regulated by the oldest regulator for banks in the United States … sends a very clear message.”

OCC Chief Brian Brooks Is Stepping Down Thursday: Brian Brooks, who was named the temporary head of the Office of the Comptroller of the Currency (OCC) last summer, made the announcement official a day after he was rumored to be departing. His departure will come a day after the federal banking regulator granted crypto custodian Anchorage a conditional trust charter, making it the first crypto-native national bank. It is unclear who incoming president Joe Biden might tap to replace Brooks. The OCC announced that chief operating officer Blake Paulson will become the new acting comptroller in the interim. Law firm Davis Polk said in a public presentation Wednesday that it is unlikely Brooks’ efforts around digital asset custody will be overturned by his successor, though further efforts around digital currencies may be slowed. Read More.

Crypto

Polkadot Price Hits Record High, Pushing Market Cap Past $10 Billion: The price of Polkadot protocol’s DOT token has increased by over 38% in the last 24 hours, pushing it to $11.36. It went as high as $11.60 in earlier trading, a new all-time high for DOT. As a result, the market cap of the token has passed the $10 billion threshold for the first time. Polkadot is a relative newcomer among blockchain networks. It was built under the leadership of Gavin Wood and Jutta Steiner of Parity Technologies, which up until last year split time between Ethereum-based projects and creating its own blockchain. Polkadot’s product positioning, the protocol isn’t as much a competitor to Ethereum as an enhancer of it. It’s designed to connect multiple blockchains together so they can be interoperable. The DOT is equal parts governance token for voting on operations and utility token for creating so-called “parachains.” Read More.

Rick & Morty Creator Is Selling NFT Artwork on Ethereum: Animator and video producer Justin Roiland will soon release a lineup of non-fungible token (NFT) art, digital art platform Nifty Gateway said in a tweet this morning. Best known for his work with the animated series Rick and Morty, the move marked Roiland’s first-ever foray into the burgeoning NFT art market—one that gained prominence in the past year with a niche audience that’s willing to shell out big amounts on crypto art. Read More.

“We are thrilled to welcome Justin Roiland to Nifty Gateway for his first-ever crypto art release. The full collection features several original artworks from Justin and will go live next Tuesday, January 19,” the platform said.

Media

BTC008: Bitcoin & Macro Mastermind Discussion w/ Lyn Alden & Luke Gromen

ETHEREUM AND BITCOIN STARTING MONSTER RALLY! THIS HAS NEVER HAPPENED...WATCH BEFORE FRIDAY!

Decentralized Infrastructure for Bitcoin

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.