Crypto Download #48

Markets Shake off Chaos at the Capital as Treasury Yields Rise to New High Levels; China's Strict Lockdowns May have Adverse Effects on Economy; Bitcoin Shakes Out Weak Hands; Don't Sleep on ETH

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

Macro

Virus & Vaccines:

CDC says 9 million Americans now vaccinated as U.S. states scramble

Another Chinese city goes into lockdown amid new COVID-19 threat

Coronavirus mutations: Here are the major Covid strains we know about

Merkel Warns on Lockdown; EU Sees Speedier Shots: Virus Update

India delivers COVID-19 shots to prepare for 'world's biggest vaccination drive'

10-year Treasury yield jumps to its highest level in nearly 10 months: U.S. Treasury yields continued to climb on Tuesday as traders eyed the possibility of further economic stimulus. The yield on the benchmark 10-year Treasury note rose to 1.174%, its highest level since March 20. The yield on the 30-year Treasury bond reached 1.904%, also a level last since in March. Yields move inversely to prices. Treasury yields moved higher, following President-elect Joe Biden’s promise last week of further economic stimulus “in the trillions of dollars.” Read More.

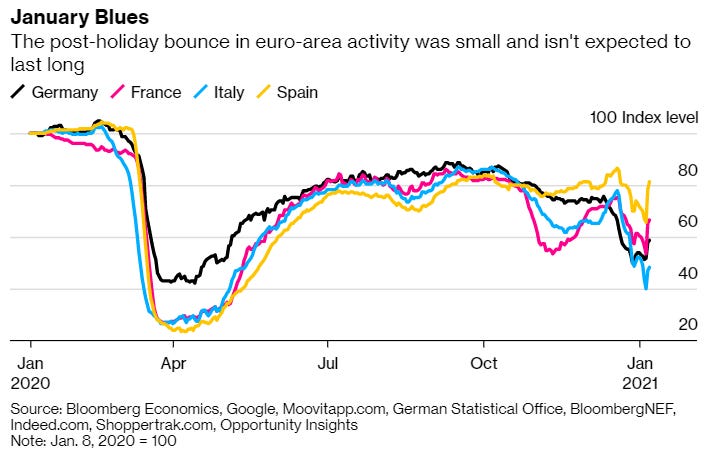

Double-Dip Recession Beckons in Europe as Lockdowns Drag On: The euro-area economy is poised to shrink again at the start of this year as the resurgent pandemic plunges the region into a double-dip recession. Analysts at banks including JPMorgan Chase & Co. and UBS Group AG are downgrading forecasts to account for renewed lockdowns -- in some places tougher than ever -- and the prospect that the new coronavirus variant ravaging the U.K. will do the same on the continent. Add vaccination delays to trade disruptions because of Brexit, and the scene is set for a second straight quarter of falling gross domestic product. That would echo the downturn at the start of 2020, even if less severe, and increase pressure on indebted governments and the European Central Bank, which meets to set policy next week, to provide more financial support. Read More.

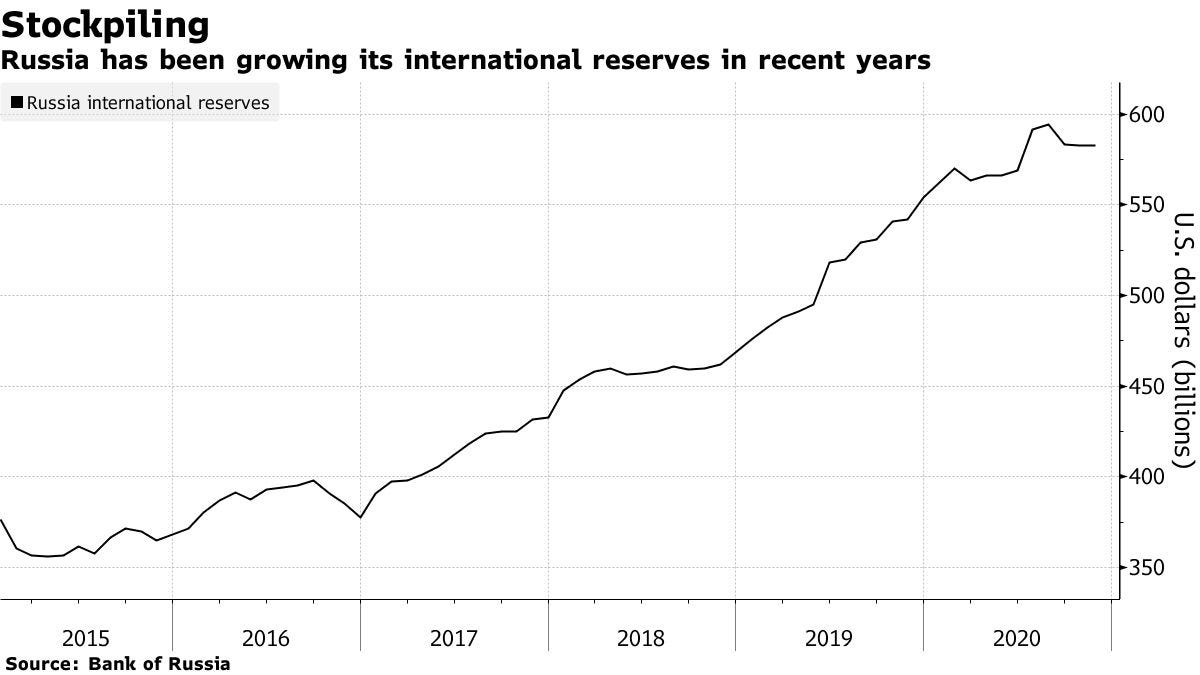

Russia for First Time Holds More Gold Than U.S. Dollars in $583 Billion Reserves: A multi-year drive to reduce exposure to U.S. assets has pushed the share of gold in Russia’s $583 billion international reserves above dollars for the first time on record. Gold made up 23% of the central bank’s stockpile as of the end of June 2020, the latest date for which data on the breakdown is available, according to a report published late Monday. The share of dollar assets dropped to 22%, down from more than 40% in 2018. The shift is part of a broader strategy outlined by President Vladimir Putin to “de-dollarize” the Russian economy and lower its vulnerability to U.S. sanctions amid deteriorating relations with Washington.

Gold is now the second-biggest component of the central bank’s reserves after the euro, which makes up about of a third of total assets. About 12% of the stash is in yuan. Russia spent more than $40 billion building a war chest of gold over the past five years, making it the world’s biggest buyer. The central bank said it stopped buying gold in the first half of last year to encourage miners and banks to export more and bring in foreign currency into Russia after oil prices crashed. The central bank also bought $4.3 billion worth of the precious metal over the period, according to the report. Read More.

CHINA

Beijing’s Virus Clampdown Spurs Food Price Surge and Shortages: Beijing’s move to prevent the spread of Covid-19 infections to the capital city is triggering a spike in food prices, with some supplies of meat and vegetables running out quickly amid fears of a shortage. The political and cultural center of China is testing truck drivers who are delivering food supplies via highways in the neighboring province of Hebei, where a city of 11 million people has been locked down after the emergence of some 200 virus cases, the country’s worst outbreak in about two months. The move has held up fruit and vegetable supplies as trucks that need to pass through Hebei to Beijing are unable to enter, said Wang Changyu, a vegetable dealer at Beijing’s biggest wholesale market Xinfadi. One local wet market visited by a Bloomberg reporter on Monday had sold out of pork early in the morning and turnips by midday. Prices of some fruits and vegetables doubled. Read More.

More parts of China lock down as virus cases spike ahead of WHO visit

China Has a Huge Wealth-Gap Problem — and It's Getting Worse

China’s Record $30 Billion Bond Defaults Seen Rising This Year

Bitcoin

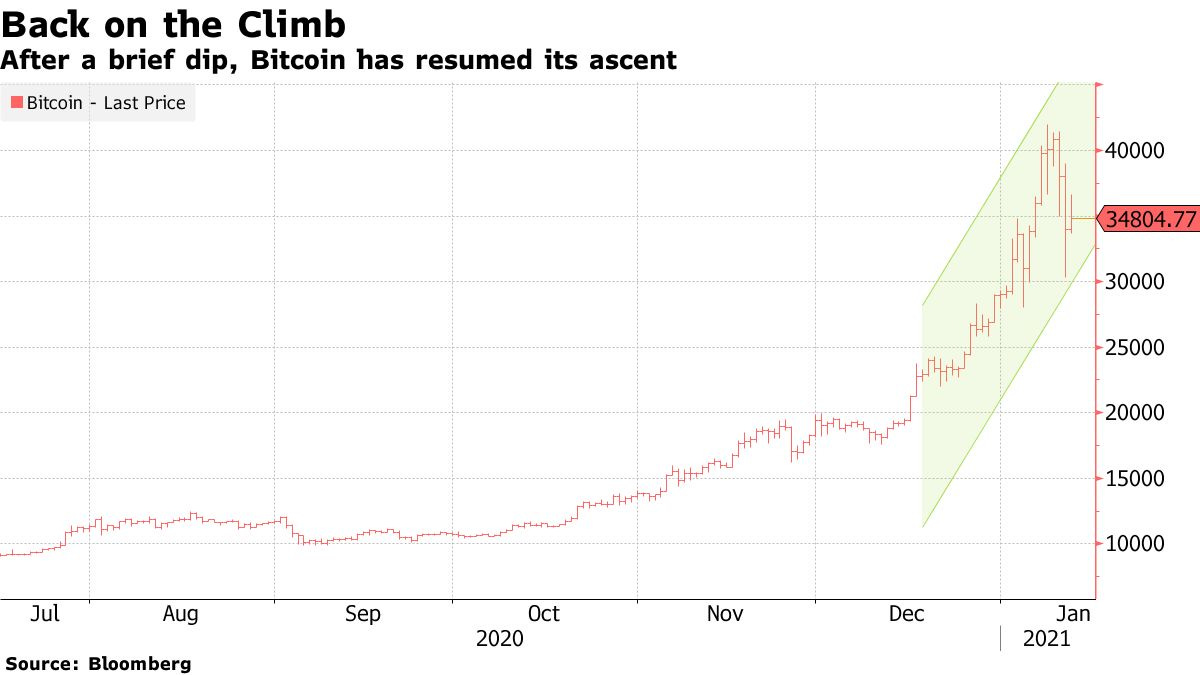

Bitcoin Rebounds While Leaving Everyone in Dark on True Worth: Bitcoin rebounded after Monday’s steep plunge left investors grasping for clues about what lies ahead for the world’s largest cryptocurrency. The digital coin rose 4.9% to $35,616 as of 11:30 a.m. in London, following yesterday’s 11% slide. The latest bout of roller-coaster volatility recalls past boom and bust cycles including the 2017 bubble, and has investors debating whether this is a healthy correction or the end of the latest bull run for cryptocurrencies. Read More.

“We think a pull back is healthy,” said David Grider, lead digital strategist with Fundstrat Global Advisors LLC, who added he doesn’t think the recent price action indicates that Bitcoin has already topped out.

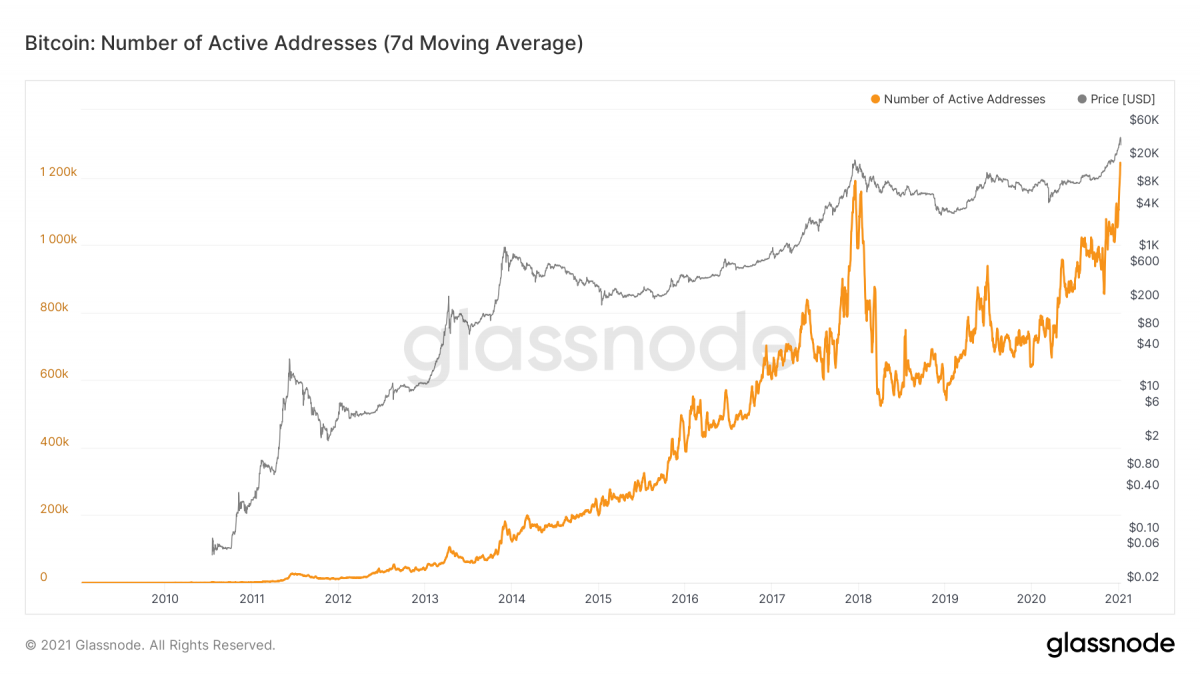

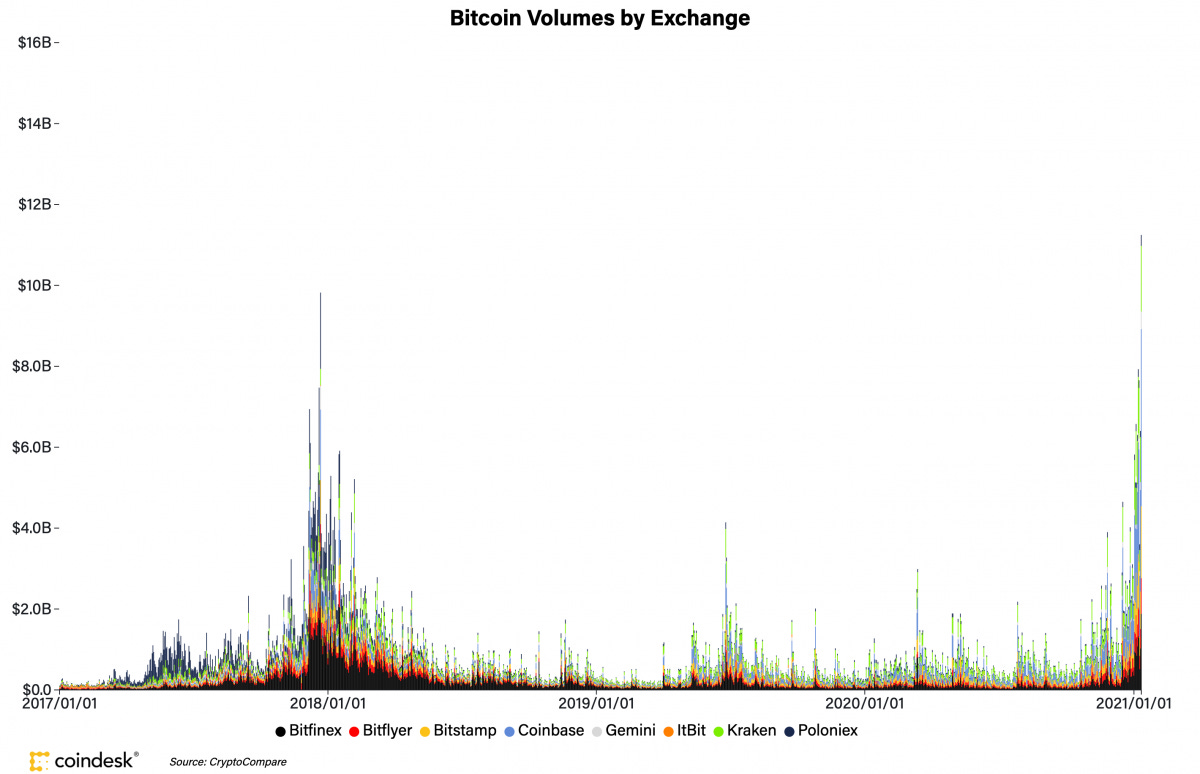

Bitcoin’s Active Addresses, Trading Volumes Now at All-Time Highs: Trading volumes and active addresses for bitcoin have now surpassed their previous all-time highs during the last crypto bull run in 2017, and the data has given some analysts confidence the bull market for bitcoin is not over yet. Read More.

"This is first and foremost a sign of how much bigger and mature the industry is, with a lot more money flowing on these exchanges," Bendik Norheim Schei, head of research at Arcane Research, told CoinDesk.

"It is great to see higher volumes, making the market more liquid and efficient….Some of this volume is definitely from new and unexperienced investors entering the market for the first time and panicking when the price starts falling," he said. "These corrections are necessary and healthy, even in a bull marke”

“At its highest point last week, over 1.3 million bitcoin addresses were active in a single day," the on-chain data analytics firm wrote in its weekly market report on Jan. 11. "This continued spike indicates an impressive level of new adoption and activity for bitcoin, and suggests that the number of market participants in the network may be higher than ever before."

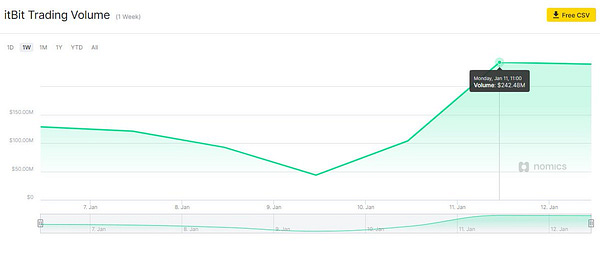

Bullish or bearish? PayPal hosts $242M in crypto trading over 24 hours: Global payments provider PayPal has doubled its previous crypto volume record, with $242 million worth of digital assets changing hands on the platform during Jan. 11. Yesterday’s trading dwarfed PayPal’s previous volume record of $129 million recorded on Jan. 6. Since Jan. 1, daily volume has increased by 950% from $22.8 million. With the spike in PayPal’s volume coming amid Bitcoin’s rally into new all-time highs, the U.S.-based payments firm appears to be gathering popularity among retail traders. Read More.

Institutions Use This Strategy to Hide Their Bitcoin Orders: Institutional investors and speculators trading large quantities of bitcoin are taking on a new method to hide the real sizes of their trades. They are doing so – many times with the quiet help of many major exchanges – to cut the risk of exposing their intent to the market, be they bullish or bearish, which can cause unfavorable price moves. A “reloading” or “refill” strategy involves breaking a large order into several small batches. For example, a trader looking to buy 1,000 bitcoin puts a bid (buy order) for 50 and waits for the exchange to execute the partial trade, say for instance 45, before refilling the order back to 50. The process is repeated until the original quantity (1,000 bitcoin) is filled. Read More.

Crypto

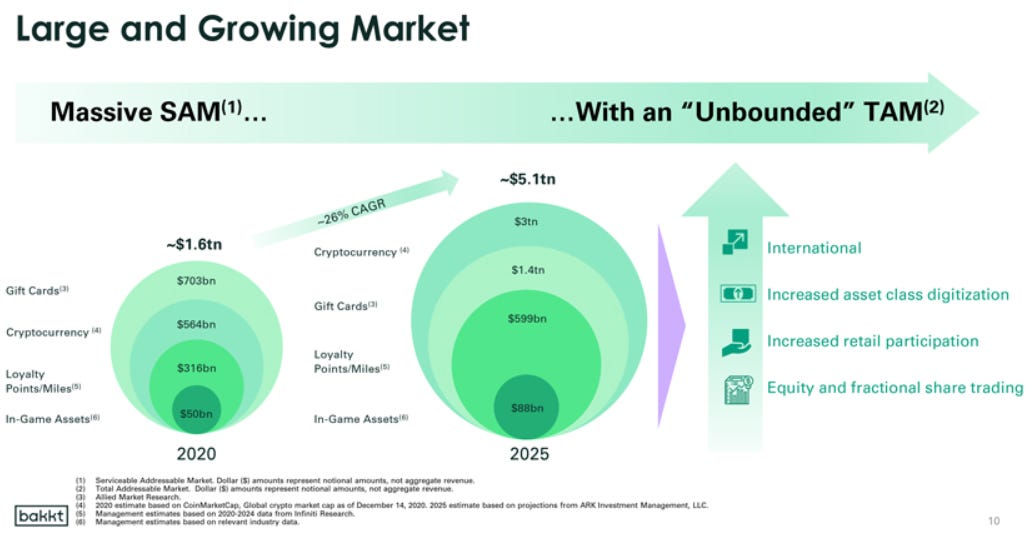

Eye-Popping Projection for $3T Crypto Market Underpins Bakkt Deal: Cryptocurrencies could grow fivefold by 2025 into a $3 trillion market, under new projections from Bakkt Holdings, the digital-asset financial firm. Bakkt published the estimate as part of an investor presentation released Monday in connection with its new plan to go public via a merger with Victory Park Capital, a special-purpose acquisition company. Bakkt is majority-owned by Intercontinental Exchange Inc., which also owns the New York Stock Exchange. The deal would give Bakkt an enterprise value of about $2.1 billion. Read More.

Institutional Rocket Fuel Could Soon Boost Ethereum, Says Macro Investor Dan Tapiero: Prominent global macro investor Dan Tapiero says Ethereum is poised to surge as a wave of institutional investors set their sights on the second largest crypto asset by market cap. Read More.

“I think investors need to really think in a different framework. I think the framework is still developing but almost anything that you used to think I think that you have to think has now changed. Bottom line if you add up all of the fiscal and monetary stimulus that was done and try to put a value on it this year, you’re looking at an amount of over $30 trillion of stimulus was put into the world economy. That’s one and half the size of the US economy injected in the world so I don’t think we even understand yet what the ramifications are.”

“It is possible that some of these institutions start to look at Ethereum, and you have not heard anything about that, as an allocation as well. I don’t want to say it’s a prediction but if you asked me like, ‘What could be a surprising thing that could happen that people aren’t thinking about?’ That would be something that would be surprising.”

“The fact that Northern Trust, which is a very staid, very traditional custodian, has come out and said that they’re going to custody cryptocurrency. Now, they have $13 trillion of assets in custody and $1.3 trillion in assets under management, and so what could happen? So they’re custodying Bitcoin and Ethereum, so I think that if we start to see that, you might really start to have another leg under Ethereum, and again Ethereum has outperformed Bitcoin this year and there’s a lot of rocket fuel there…

Ethereum is not digital gold. It’s something completely different… If Northern Trust is going to custody Bitcoin and Ethereum, that means they have clients that want to buy both of them.”

HashKey Capital Invests $5M in Decentralized Storage Project Filestar: Web 3.0 decentralized storage and infrastructure network Filestar has received multi-million dollar funding from Hong Kong’s HashKey Capital. Read More.

"We see potential in the project to transform the storage mining landscape and establish a blockchain-based decentralized marketplace for computing-power and bandwidth sharing,” said Ryan Chen, director of strategy at Hashkey.

Media

Central Bank Omnipotence: Can They Spark Growth & Inflation? (w/ Jeff Snider & Ed Harrison)

Willy Woo: How Bitcoin Reaches up to $300,000 by End of Year - Ep.207

BTC006: Bitcoin & the Macro Backdrop - w/ Brent Johnson from Santiago Capital

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.