Crypto Download #46

All Eyes on Georgia Senate Race; More Financial Firms Head to Miami; UK Enters 3rd Lockdown; OCC Confirms Banks can use Stablecoins; JPM's $146K BTC Price Prediction; Altcoins Heat Up

Excited to have you on this macro bitcoin and crypto journey. Please share the newsletter with anyone who may be interested in joining us. Follow me on Twitter for Live Updates: @mverklin

ICYMI:

Macro

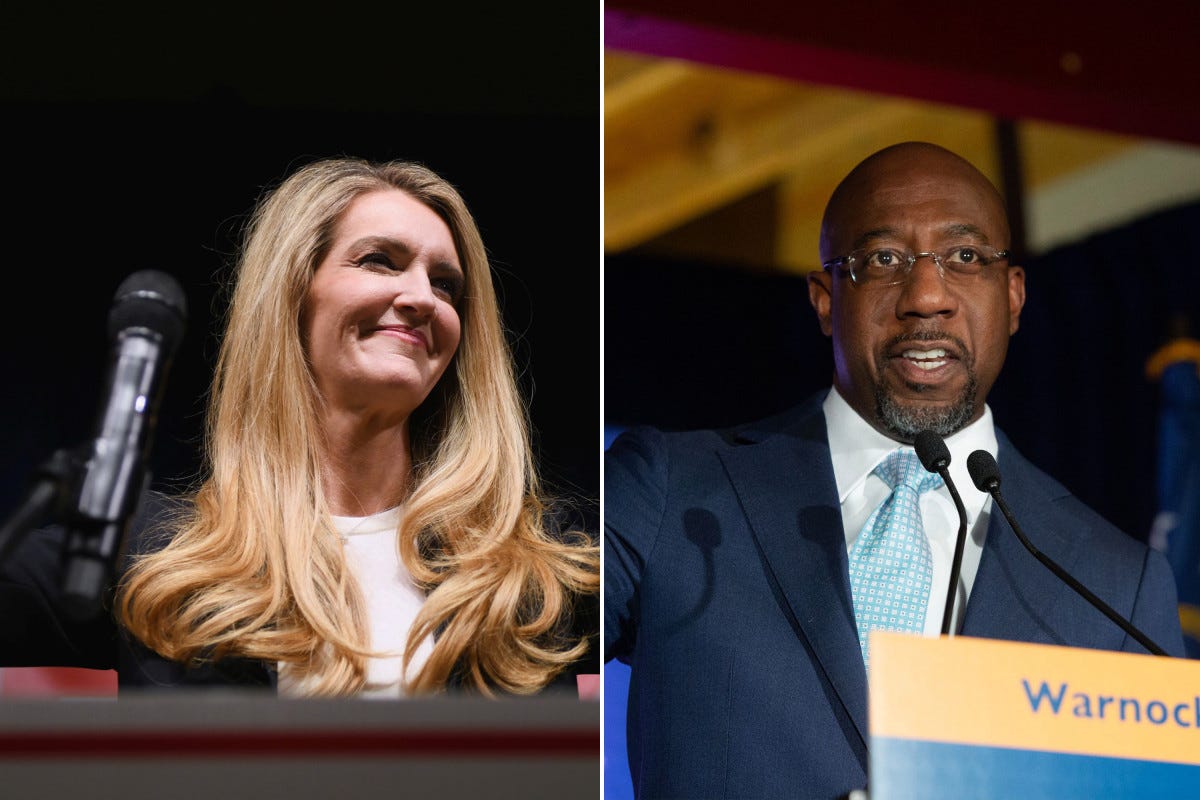

Georgia Heads to Polls for Crucial Senate Races: Two runoffs in Georgia on Tuesday will decide which party controls the U.S. Senate, and with it, the fate of President-elect Joe Biden’s agenda. If Democrats Jon Ossoff and Raphael Warnock both win, Vice President-elect Kamala Harris would provide any tie-breaking vote to give the party control of the Senate. That would give Biden the chance to shape a more generous stimulus package and pursue other legislative goals on health care, climate change and immigration. Read More.

Low Taxes and High Temperatures Lure Finance Firms to Miami: This city has long pitched itself as an attractive location for finance and tech firms, with its tax advantages, flight connections to New York and cosmopolitan flair. Its efforts appear to be paying off. Private-equity giant Blackstone Group Inc. unveiled plans in October to open an office in the city to serve its internal technology needs that will eventually employ 215 people. Billionaire financier Carl Icahn moved his company to nearby Sunny Isles Beach earlier in 2020. Real-estate investor Starwood Capital Group is building a sleek new 144,000-square-foot headquarters in Miami Beach. Read More.

Commodities:

Bishop’s Impala Fund, Up 30% in 2020, Sees Commodity Bull Market

Virus Chaos Slashes India’s Gold Imports to Lowest since 2009

South African Stocks Climb as Haven Demand Boosts Gold Miners

Britons ordered to stay at home as third national lockdown begins: Britain began its third COVID-19 lockdown on Tuesday with citizens under orders to stay at home and the government calling for one last major national effort to stem the virus before mass vaccinations turn the tide. Sunak’s latest package of grants adds to the eye-watering 280 billion pounds in government support already announced for this financial year to stave off total economic collapse. Read More.

“I definitely think it was the right decision to make. The NHS hospitals are really full so we’re in a similar position as we were in lockdown number one,” said Londoner Kaitlin Colucci, 28.

“This will help businesses to get through the months ahead – and crucially it will help sustain jobs, so workers can be ready to return when they are able to reopen,” he said in a statement.

Japan's state of emergency seen triggering first-quarter economic contraction: Japan’s likely decision to declare a state of emergency in the Tokyo area will most probably trigger a contraction in January-March, analysts say, adding to the headache for policymakers struggling to cushion the blow to the economy from the pandemic. The world’s third-largest economy rebounded sharply in the third quarter last year from a record April-June slump caused by the pandemic, heightening expectations a moderate recovery. But such hopes have been dashed by a resurgence in COVID-19 infections that have forced the government to consider imposing a state of emergency that could last about a month. Read More.

Drugmakers kick off 2021 with 500 U.S. price hikes: Drugmakers including Abbvie Inc and Bristol Myers Squibb raised U.S. list prices on more than 500 drugs to kick off 2021.The hikes come as drugmakers are reeling from effects of the COVID-19 pandemic, which has reduced doctor visits and demand for some drugs. They are also fighting new drug price-cutting rules from the Trump administration, which would reduce the industry’s profitability. They include more than 300 price increases from companies like Pfizer and GlaxoSmithKline reported by Reuters late last week. Read More.

Bitcoin

OCC Regulator Implements Groundbreaking Cryptocurrency Guidance For Banks And The Future Of Payments: Today the OCC published Interpretive Letter 1174, which explains banks may use new technologies, including independent node verification networks (INVNs) and stablecoins, to perform bank-permissible functions, such as payment activities. Said simply, a bank may use stablecoins to facilitate payment transactions for customers. In doing so, a bank may issue stablecoins, exchange stablecoins for fiat currency, as well as validate, store, and record payments transactions by serving as a node on a blockchain (INVN). While the United State’s financial system functions relatively smoothly, traditional payment rails are still slow, expensive and subject to banking hours and holidays. The OCC’s guidance opens the possibilities that banks will use INVNs and stablecoins to transfer funds between financial institutions faster and without the need of a government intermediary. Read More.

Kristin Smith, Executive Director of the Blockchain Association noted to me, “ The OCC’s interpretive letter shows that there are those in government who actually understand that cryptocurrency networks are the foundation of a next generation payments system. Stablecoins, like USDC, can power faster, 24-hour real time payments in a way that existing US payments infrastructure can’t handle.”

Nic Carter, Partner of Castle Island Ventures added, this will allow banks “to take advantage of the always-on features of public blockchains.”

JPMorgan Says Bitcoin Could Surge to $146,000 in Long Term: Bitcoin has the potential to reach $146,000 in the long term as it competes with gold as an asset class. Bitcoin’s market capitalization of around $575 billion would have to rise by 4.6 times -- for a theoretical price of $146,000 -- to match the total private sector investment in gold via exchange-traded funds or bars and coins, strategists led by Nikolaos Panigirtzoglou wrote in a note. But that outlook depends on the volatility of Bitcoin converging with that of gold to encourage more institutional investment, a process that will take some time. Read More.

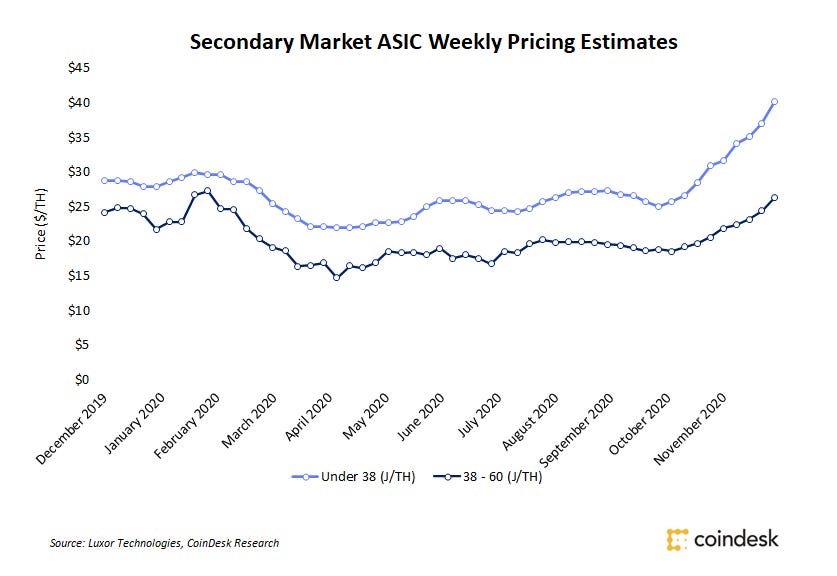

Bitcoin Mining Machine Shortage Worsens as Bitmain Sells Out Through August: In early December, Bitmain was pre-selling bitcoin ASIC miners with an expected shipping date of May 2021. Less than a month later, Bitmain has sold out through August 2021 and has raised its prices significantly. In late November, Bitmain’s Antminer S19 was priced at $1,897. Now, the same machine sells for $3,769, a 98% markup. Those massive orders are coming from mining firms like Riot Blockchain (RIOT), which bought over 31,000 new machines this year; Core Scientific, which bought 59,000 machines from Bitmain in one order, and Marathon Patent Group (MARA) which expanded its mining fleet to over 100,000 machines. Read More.

SkyBridge’s Bitcoin Cache Rises to $310M as New Fund Launches: Skybridge Capital, the hedge-fund investing firm headed by Anthony Scaramucci, confirmed its launch of a new bitcoin fund Monday and said its exposure to bitcoin has already reached $310 million. Read More.

“With global money printing at an all-time high, bitcoin offers a strong alternative to gold as a store of value and hedge against future inflation,” Ray Nolte, SkyBridge's co-chief investment officer, said in the press release.

Tech Fights FinCen Crypto Regulation:

Andreessen Horowitz joins push against FinCEN's 11th-hour crypto rules

Effectively, the new regulation would "would require various cryptocurrency entities to collect and report detailed personal identifiable information of their customers’ counterparties…Haun noted that this standard is "applied to no other sector of the financial industry today."

Jack Dorsey says proposed cryptocurrency regulation would create ‘perverse incentives’

“The burdensome information collection and reporting requirements deprive U.S. companies like Square of the chance to compete on a level playing field to enable cryptocurrency as a tool of economic empowerment.”

Crypto

Reef Finance debuts as the first Polkadot project on Binance Launchpool: Pioneering DeFi on Polkadot with Reef Finance (REEF): Reef gives retail investors access to the DeFi landscape with a very low technical barrier of entry, while at the same time, it augments the decision making process based on users’ risk levels. The strategic collaboration enables Binance users to take advantage of crypto purchases with fiat and trading through the Reef Finance platform in a non-custodial manner. In addition, Reef Finance is eyeing the potential offering of Binance Chain support to its users in the future. Read More.

“Binance Launchpool, a new initiative designed to bring the decentralized finance experience to Binance users, today announced its new project, Reef Finance — a multi-chain smart yield engine and liquidity aggregator where any financial hub can integrate into.”

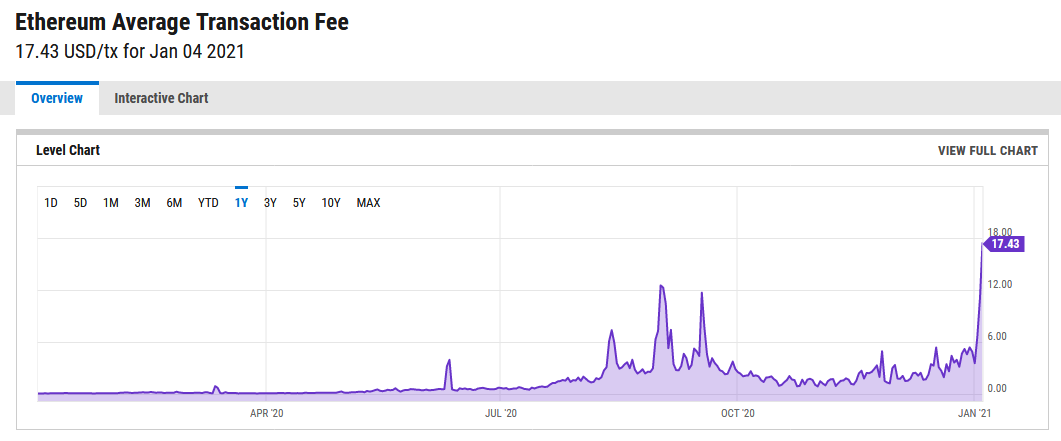

Ether fees nearly double as 24-hour trading volume tops $50B: The $17.43 per transaction constitutes an all-time high in average Ether fees beating the previous record of $12.54 back in September during the height of the DeFi mania. As of press time, ETH transaction fees have declined significantly, with a median fee of $1.63 based on data from Etherscan, ETH Gas Station and Gas Now. Read More.

Popular Trader Says ‘Dark Horse’ Crypto Asset Set to Erupt This Year: Smart contract platform Elrond (EGLD), which sits at the 49th spot in overall market cap, is Davis’ ‘dark horse’ pick for this altseason. Davis highlights Elrond’s strong tokenomics and numerous partnerships, saying that he believes the recent hype surrounding the platform is well deserved. Read More.

“Elrond is basically everything ETH 2.0 wants to be, but today. They even had a massive shakeup to the tokenomics with a push for Bitcoin-like scarcity and Ethereum-like functionality… I think this is going to be an absolute star of the bull run so make sure to have this one on your radar…Elrond has more partners than a lot of these chains that have been around for three or four years have. It’s incredible, the ecosystem they’ve already built out… Elrond has been able to create this unbelievable exosystem really only behind Ethereum or Polkadot.”

Media

BITCOIN CORRECTION OVER OR JUST STARTING!!!! [WATCH TUESDAY]

SkyBridge Capital’s Bitcoin Fund with Anthony Scaramucci

2021 Kickoff: Looking Through the Headlines (w/ Mike Green and Max Wiethe)

Cheers,

Verks

**This is not financial advice. Investing in bitcoin and cryptocurrency is extremely risky. Please do your own research. The ideas and news presented in this newsletter are my personal opinions and meant for informational and entertainment purposes only.