Bitcoin vs. The Petrodollar

Which is greener? Reframing Bitcoin's energy "problem."

@palerlotus

Reframing Bitcoin’s Energy Consumption:

It’s all about perspective, having an open mind and challenging existing frameworks.

Does the Bitcoin network have an energy problem? Yes, bitcoin currently uses a ton of energy to secure the network through the process of mining. But, the real questions are:

What percentage of bitcoin mining is coming from fossil fuels vs. renewable energy?

Will Bitcoin mining become more efficient and environmentally friendly in the future?

Why does Bitcoin mining consume so much energy?

Is Bitcoin worth its energy consumption compared to other use cases?

How much energy does our current financial system use?

Why aren’t we talking about the Petrodollar’s energy footprint?

Data:

Source: University of Cambridge Centre for Alternative Finance (CCAF)

There’s no exact answer for Bitcoin’s energy consumption and mix given the global, anonymous and ever changing nature of Bitcoin mining.

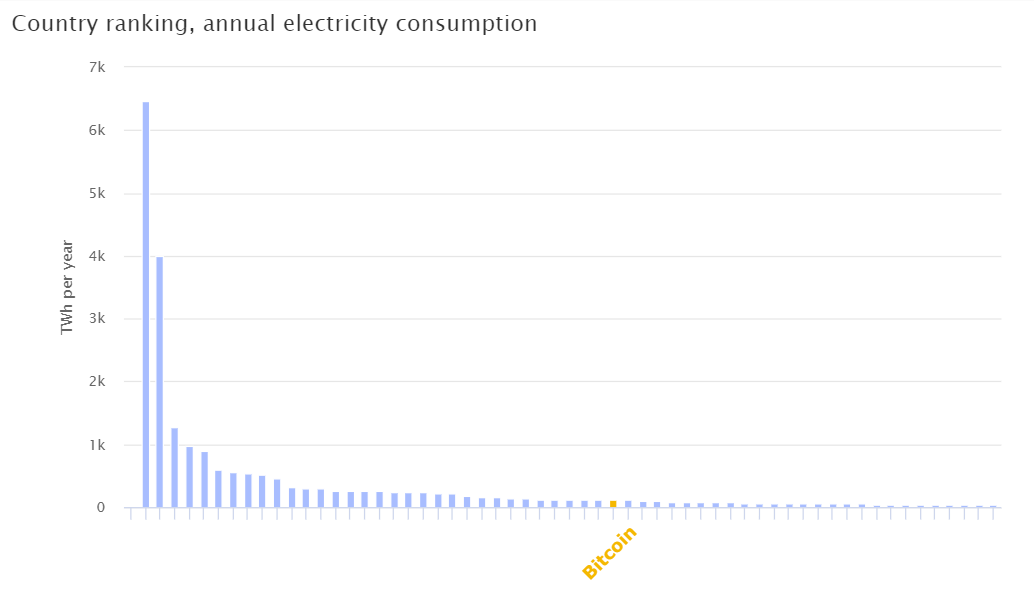

Bitcoin currently consumes 118.94 Terawatt Hours per year — 0.55% of global electricity production, sitting between the Netherlands (110.68 TWh per year) and The United Arab Emirates (119.45 TWh per year). The top three countries are China, the United States and India.

It’s estimated that miners are earning $1M per hour, an 185% increase since the halving in mid-May 2020. Total annual revenue derived from mining bitcoin is estimated to be $13 billion, which makes mining an attractive business for future entrants and capital investment.

The ingredients for a profitable bitcoin mining operation are cheap electricity, the most efficient mining equipment and scale. Mining is an extremely competitive and capital intensive business.

What percentage of Bitcoin mining is from renewable energy? Will it be greener in the future?

Renewable Energy:energy from a source that is not depleted when used, such as wind or solar power.

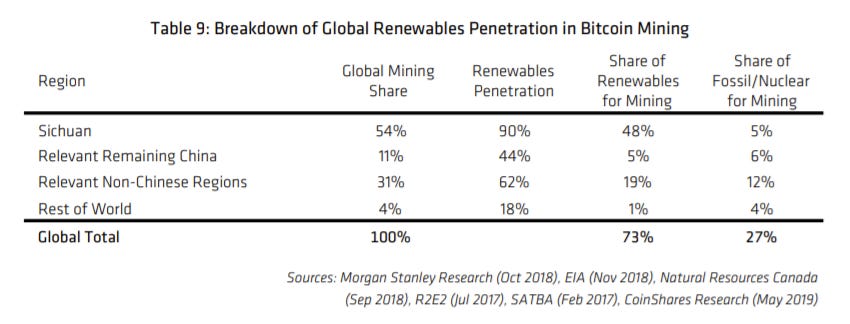

In a December 2019 report, Coinshares suggested that ~73% of Bitcoin’s energy consumption was from renewable energy due to the large amount of hydro mining facilities in Southwest China. In September 2020, the CCAF estimated that 39% of the energy consumed for mining Bitcoin came from renewable energy.

The truth may fall somewhere in the middle. However, if we zoom out then these numbers are more promising than mainstream media gives Bitcoin credit. The network is 12 years young with nearly half of it’s energy coming from renewables. Data shows renewable energy is getting cheaper and on trend to phase out fossil fuels (infographic below). Given that cheap electricity is part of the equation for a profitable mining operation, there’s billions of dollars of incentives for miners to become 100% renewable. It’s safe to say Bitcoin mining will be greener in the future.

Why does Bitcoin mining consume so much energy?

Bitcoin uses a Proof of Work (POW) consensus algorithm, which is a fancy computer science term for a computational intensive guessing game. POW is needed for the network to come to consensus on which transactions are valid and will be included in the blockchain. One of the main computer science breakthroughs regarding Bitcoin is a solution to the Byzantine General’s Problem, or the ability to come to full agreement amongst a network of distributed strangers / competitors. In other words, global distributed trust.

Through the creative use of POW, miners are using specialized equipment to guess a random number (more precisely a random hash) between 1 and 2^256 (unimaginable range) in order to claim the Bitcoin block reward. These random guesses are what causes Bitcoin’s energy consumption. The guessing game or puzzle is hard to solve in terms of the amount of work (guesses), but easy to verify using hash function cryptography, which makes it perfect for bitcoin’s security and trustless model. It prevents network attacks (DDoS) and guarantees transaction validity (double spend problem) by making it extremely costly to hack or create false transactions. This makes Bitcoin the strongest computing network in the world and why it’s never been hacked. It’s completely decentralized as anyone can mine the network or run a full-node to verify transactions.

Is it worth it?

This is the most important question with regard to Bitcoin’s energy consumption and it’s best answered by putting things in context.

What is money? And, why is money valuable?

Money is simply a technology. We created money for a few reasons.

Store value over space and time

Use as a medium of exchange

Use as a unit of account

Money allowed civilization to move away from barter, create savings and scale trade. This technology, like most technologies created more time for other things - specialization, learning to paint, “Netflix & Chilling” and spending more time with loved ones. Therefore, money is a measurement tool for capital investment and more importantly for one’s time and efforts. Some, might say that money is the most important technology ever invented next to language.

Back to bitcoin’s energy consumption…

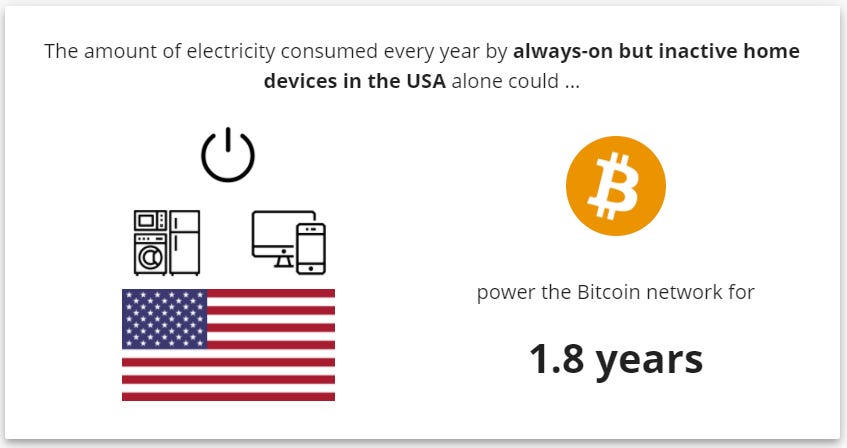

We literally consume energy for everything we do. The energy that flows through our cities’ grids powers our lights, our heat and our video games. This is where energy consumption becomes highly subjective, but it’s necessary to keep things in context. For example, the amount of electricity consumed every year by always-on but inactive home devices in the United States could power the Bitcoin network for 1.8 years.

Source: NRDC Issue Report (2015)

The point is…

Energy is consumed for many different reasons, some more important than others. However, we all need money and Bitcoin was engineered as better money. A deflationary currency, one that’s designed to increase in value over time and provide more buying power (ability to purchase goods and services) tomorrow than today (long-term). When you look at Bitcoin as technology for improved and completely decentralized money that’s separate from government control with an immutable public record of the truth; then it’s energy consumption doesn’t look as bad.

And, given the fact that Bitcoin provides more wealth and time back to its users, then perhaps it’s actually worth its energy consumption.

Not sold yet?

That’s fine. Let’s take a different perspective and look at the energy consumption and waste of our existing financial system.

How much energy does our current financial system consume?

First, let’s breakdown what we mean by our “current financial system.”

Fiat money- government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money. Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies. One danger of fiat money is that the government will print too much of it resulting in hyperinflation.

With the creation of the Federal Reserve in 1913, “the lender of last resort,” the United States has instituted market manipulation and crony capitalism. Since, leaving the gold standard in 1971, the world has been experimenting with a new financial system. A pure fiat paper currency system based on debt, in particular government debt.

Free and open markets are self-regulating. When the market starts to overheat, a sell-off ensues and a healthy correction takes place. As the market naturally finds equilibrium, it separates the good participants from the bad participants. While this is painful in the short-term, the remaining market players create a healthier overall market with better risk management in the long-term.

Humans are emotional and tend to think short term.

In a world of central banks, when the market rolls over, “the lender of last resort” intervenes in order to keep “the system” functioning.

In order to keep the system functioning, more debt and currency creation is necessary to facilitate lending and paper-over the cracks. This breathes life into the system’s non-productive assets. Ultimately, the central bank’s intervention prevents the market from clearing malinvestment and devalues the currency as the money supply increases. These centralized shortsighted decisions keep bad businesses in operation, which only wastes more energy.

This is part of how an inflationary currency works. The currency or money supply is guaranteed to expand and buy less goods and services tomorrow than today (long-term).

@danheld

Today’s fiat currency and financial system creates incentives to spend vs. save as dollars lose value over time. The currency no longer serves the first principle of money, a store of value. Therefore, the incentive structure creates a sense of urgency to find other stores of value by taking on additional risk. A race against time.

Back to energy consumption…

When people are rushed or stressed, do they make good decisions? No, generally not. It’s the same with financial decisions. When you’re money is losing value, the clock is ticking. You either spend (consume) or invest. Investing isn’t easy, hence why money managers are paid so much.

When money is cheap in a debt based system, it means debt is cheap and therefore, individuals are incentivized to take on debt. When the costs of capital is near zero, there’s a greater chance of investment flowing into non-productive means and assets (malinvestment). Over consumption and malinvestment are two symptoms of our fiat currency and debt based financial system.

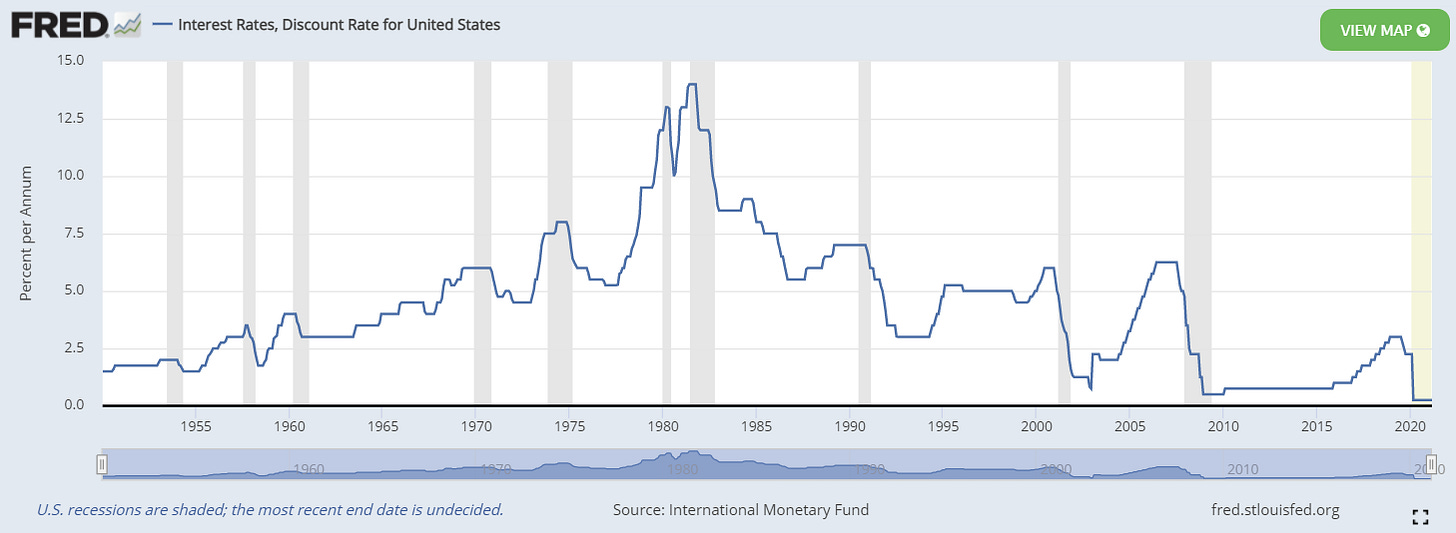

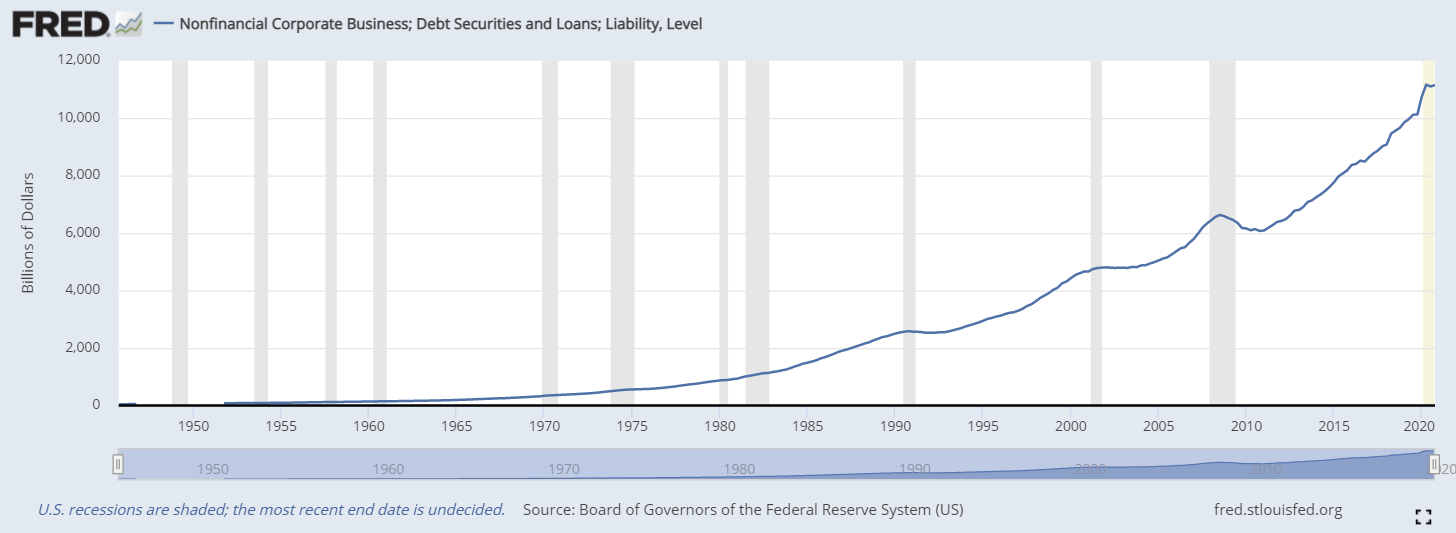

US Interest RatesUS Nonfinancial Corporate DebtIf we use energy for everything, that means we are using energy for our banking infrastructure, for malinvestment and over consumption. Here are some examples to help illustrate our current system’s energy footprint and waste.

The estimated global production costs of paper currency in 2014 were 5 terawatts per year and 10 billion liters of water

Banking’s energy costs are calculated around 100 terawatts per year

In the U.S. alone, there are 80,000 bank branches and 470,000 ATMs

America’s zombie companies racked up $2 trillion of debt in 2020

There are more shopping malls than high schools in the US, 116k shopping malls (2017)

Percent of adults aged 20 and over with obesity: 42.5% (2017-2018)

Percent of adolescents aged 12-19 years with obesity: 21.2% (2017-2018)

Mean carbohydrate intake for men: 46.4%

Mean carbohydrate intake for women: 48.2%

While the world wastes about 1.4 billion tons of food every year, the United States discards more food than any other country in the world: nearly 40 million tons — 80 billion pounds — every year.

Do we really need or want this type of excess? I’m not sure we do, and if we look at the global carbon footprint, I’m willing to bet that our existing banking system and our over consumption are a bigger contributors than mining bitcoin.

The Petrodollar

@adambanaszek

What is the Petrodollar?

Petrodollar- a U.S. dollar paid to a petroleum exporter in exchange for oil.The Petrodollar System describes the complex web of diplomatic, monetary and economic relationships connecting the oil & gas industry with the US monetary system, and ensuring the US dollar as the world’s reserve currency.

In 1971, President Nixon officially ended the gold standard as the US government was unable to meet their international liabilities and convert dollars into gold for partner countries like France and Britain. Following suit, the dollar quickly lost over 10% of it’s value and the dollars held by global central banks lost their backing. This called into question US dominance and the dollar’s central role as the reserve currency.

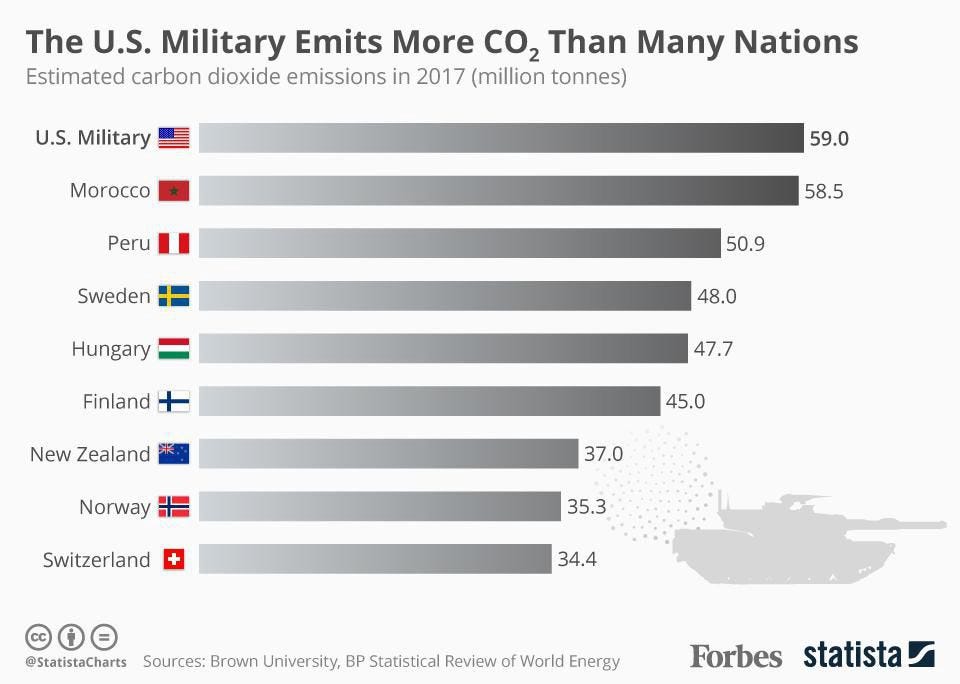

Then in 1974, President Nixon and Secretary of State and National Security Advisor, Henry Kissinger made a deal with Saudi Arabia to save the dollar’s reserve currency status with “black gold.” The deal between the US and Saudi Arabia was simple; the US will buy oil from Saudi Arabia and provide the kingdom military aid and equipment and in return, the Saudi’s will drive their petrodollar revenues into US Treasury securities to finance US spending. The rest of the oil producing nations (OPEC - 80% of the world’s oil reserves) quickly joined and if other countries wanted to buy oil, they had to trade in US dollars. These political actions increased the US dollars’ network effects and married the fiat currency to fossil fuels and the sale of oil. Without plunging into all of the Petrodollar system’s geopolitical and cultural consequences, one can simply look at the US military’s consumption of energy and its carbon footprint as a direct result from our current financial system.

The US military is the world’s largest institutional consumer of oil, using more than 100 million barrels per year for its ships, vehicles, aircraft, and various ground operations.

This generates the equivalent of 59 million tonnes of CO2 emissions, more than some countries.

Conclusion

The world is not perfect and nor is Bitcoin’s energy consumption, however, if we’re going to have an honest conversation about the role of money and it’s energy footprint, we need to zoom out, examine all options and question existing frameworks.

There’s no question today that the world runs on fossil fuels and that’s probably not going to change any time soon. However, incentives matter and bitcoin has already proved to be a monetary incentive towards clean renewable energy. And, simply put, there’s no comparison to the incentive structure created by the Petrodollar system that’s dependent on the demand for fossil fuels.

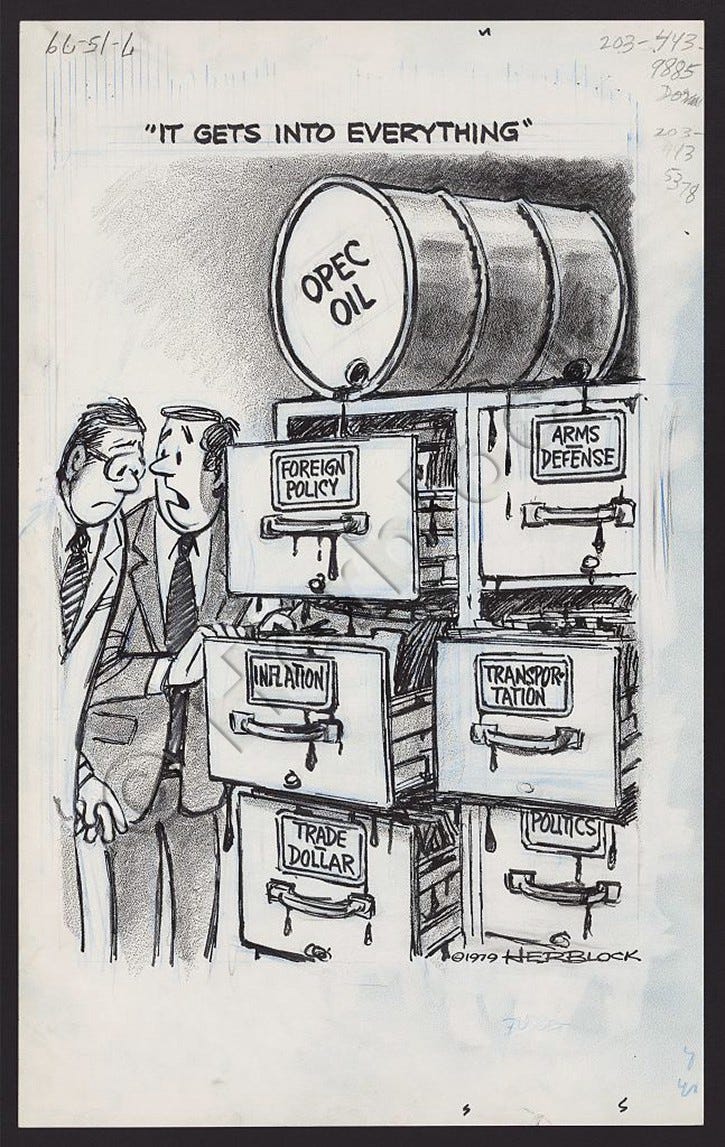

Source: Herb Block, archived at The Library of Congress

Fix the money. Fix the world.

The cartoon above says it all. There’s no doubt that our fiat currency and debt based financial system have real cultural and environmental consequences. It’s even more explicit to have the world reserve currency directly tied to oil. This has only accelerated and deepened the world’s energy consumption problems.

At least Bitcoin gives us an alternative, one that takes a different approach to money and incentivizes the adoption of clean renewable energy.

Fix the money. Fix the world.

Reminder:Content is moving behind the paywall this month. Subscribe to get the daily newsletter, digital asset research and analysis and exclusive articles and media.

THIS IS NOT FINANCIAL ADVICE. IT’S IMPORTANT TO DO YOUR OWN RESEARCH. INVESTING IN CRYPTOCURRENCY OR ANYTHING FOR THAT MATTER COMES WITH RISK. THE INFORMATION PRESENTED IN THIS NEWSLETTER IS FOR INFORMATION AND ENTERTAINMENT PURPOSES ONLY.